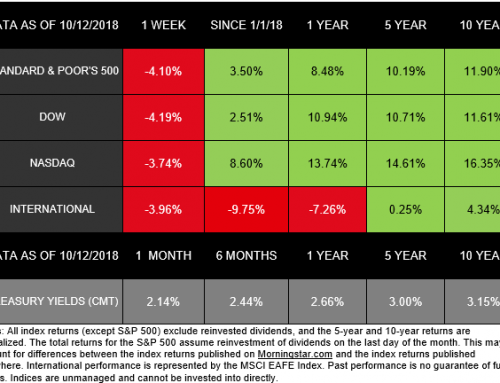

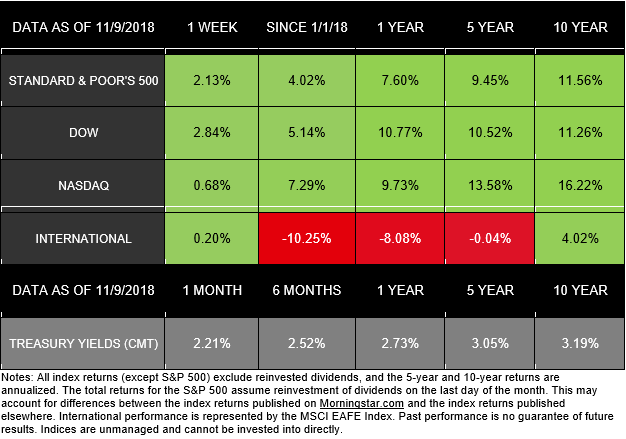

Last week, markets experienced a 4-day winning streak before dropping on Friday, November 9. Despite those losses, domestic indexes posted gains for the week.[1] The S&P 500 increased 2.13%, the Dow added 2.84%, and the NASDAQ was up 0.68%.[2] International stocks in the MSCI EAFE had slight growth, ending the week up 0.20%.[3]

From interest rates to corporate profits, investors had a number of topics to consider. [4] In this update, we want to focus on two key details that drove markets: oil prices and midterm election results.

1. Oil Prices Declined

Oil prices continued to fall last week, posting the most consecutive daily declines in at least three decades.[5] In fact, West Texas Intermediate (WTI) futures, a key oil benchmark, is officially in bear market territory. WTI has fallen more than 20% below its highest point over the past year.[6]

What does this drop mean for markets?

Some investors believe the price declines are another sign that the global economy is slowing down. Historically, people have used oil prices as one way to decipher economic health because they can correlate with global growth. When crude oil prices drop, greater economic challenges are often ahead.[7]

This recent decline may have a less concerning explanation. The United States sanctioned Iran last week while allowing eight nations to continue buying oil from the country for now.[8] All of these waivers resulted in 1 million more barrels of Iranian oil being on the market than expected, the opposite of the anticipated tightening supply.[9]

Bottom line: The oil price decline may be more of a symptom of disrupted supply and demand, rather than an indication of the global economy’s health.[10]

2. Midterm Elections Brought Few Surprises

The long-awaited midterm elections occurred last week, and the results matched expectations for a split Congress.[11] These results contributed to the midweek market rally we experienced.[12]

How could the results affect markets?

Post-midterm market results are generally strong. Over the past 18 midterm elections, stocks have always had positive returns from their lows in October to the year’s end. Some investors even believe that October’s struggles were a sign of the markets pricing in the election results about a month early.[13]

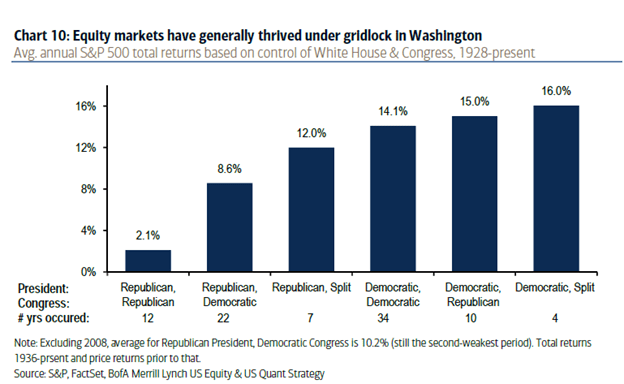

Taking a historical, long-term view, the current arrangement of a Republican president and a split Congress has resulted in 12% annual returns since 1936. The chart below shows how markets have performed through each potential party-control scenario.[14]

Although stocks have often done well when Washington experiences gridlock, the current scenario also makes a government shutdown or increased investigations into President Trump more likely. With either of these actions, market volatility could follow.[15]

Bottom line: The election results could help bolster market performance. The split Congress also brings potential for political uncertainty that increases volatility for investors.[16]

In many ways, this week’s market behavior underscores the complex, interconnected relationships between geopolitics and the markets. If you have any questions or would like to dive deeper into how these situations affect your financial life, we’re here to talk.

ECONOMIC CALENDAR

Monday: U.S. Holiday: Veterans Day observed

Wednesday: CPI

Thursday: Retail Sales, Import and Export Prices, Business Inventories, Jobless Claims

Friday: Industrial Production

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-COMPLIMENTARY borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,

Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] https://www.marketwatch.com/story/dow-looks-set-to-sink-by-triple-digits-after-fed-update-as-oil-extends-fall-2018-11-09?dist=markets

[2] http://performance.morningstar.com/Performance/index-c/performance-return.action?t=SPX®ion=usa&culture=en-US

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=!DJI®ion=usa&culture=en-US

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

[3] https://www.msci.com/end-of-day-data-search

[4] https://www.cnbc.com/2018/11/09/stock-market-us-futures-lower-after-fed-decision.html

[5] https://www.reuters.com/article/us-usa-stocks/oil-slide-china-worries-send-wall-street-tumbling-idUSKCN1NE1GQ

[6] https://www.cnbc.com/2018/11/09/stock-market-us-futures-lower-after-fed-decision.html

https://www.investopedia.com/terms/w/wti.asp

[7] https://www.marketwatch.com/story/stock-market-investors-wrestle-with-a-glut-of-bearish-signs-as-oil-prices-plunge-2018-11-10

[8] https://www.reuters.com/article/us-usa-stocks/oil-slide-china-worries-send-wall-street-tumbling-idUSKCN1NE1GQ

[9] https://www.marketwatch.com/story/stock-market-investors-wrestle-with-a-glut-of-bearish-signs-as-oil-prices-plunge-2018-11-10

[10] https://www.marketwatch.com/story/stock-market-investors-wrestle-with-a-glut-of-bearish-signs-as-oil-prices-plunge-2018-11-10

[11] https://www.bloomberg.com/news/articles/2018-11-07/this-time-stocks-got-it-right-now-about-that-october-rout

[12] https://www.cnbc.com/2018/11/09/stock-market-us-futures-lower-after-fed-decision.html

[13] https://www.bloomberg.com/news/articles/2018-11-07/this-time-stocks-got-it-right-now-about-that-october-rout

[14] https://www.cnbc.com/2018/11/05/market-history-shows-investors-should-hope-for-gridlock-on-election-day.html

[15] https://www.cnbc.com/2018/11/05/market-history-shows-investors-should-hope-for-gridlock-on-election-day.html

[16] https://www.cnbc.com/2018/11/05/market-history-shows-investors-should-hope-for-gridlock-on-election-day.html