OUR BLOG

June 2025

Understanding the Tax Treatment of Life Insurance in Retirement

When people think about retirement planning, they often focus on IRAs, 401(k)s, and investment portfolios. But for many retirees, life insurance can play a strategic role, especially when it comes to navigating taxes. Whether you're considering a new policy, already own one, or [...]

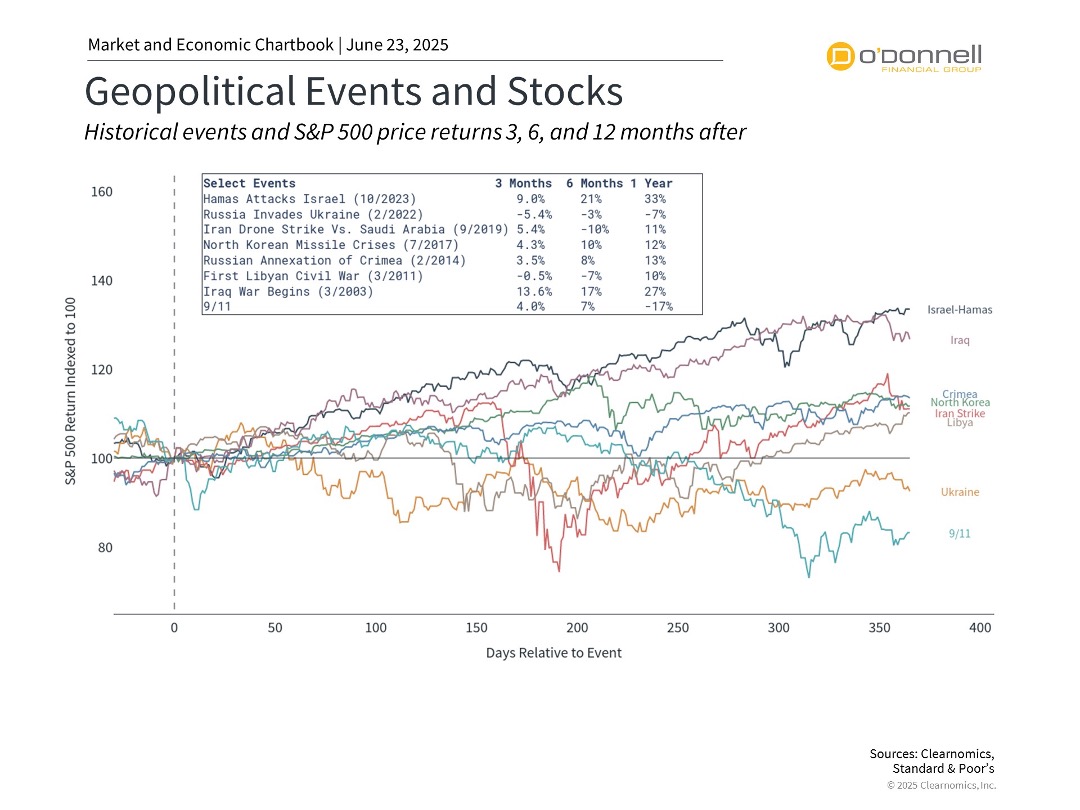

The Middle East Conflict: How Wars Impact Investors – UPDATED

The conflict between Israel and Iran has captured global attention and created uncertainty in financial markets. Israeli strikes on Iranian nuclear facilities and military targets began on June 13 and quickly led to retaliatory attacks. Then, on June 21, the U.S. launched strikes [...]

Does Retirement Have to Happen All at Once?

Imagine transitioning into retirement not as a sudden leap but as a gradual, comfortable glide. This approach, known as phased retirement, is gaining popularity. It allows people like you to reduce working hours over time, allowing a smoother shift from full-time employment to [...]

Estate Planning Important Considerations Amid Political Uncertainty

After a lifetime of working hard, saving diligently, and investing wisely, one of the key considerations is how to pass these assets to future generations. This is where estate planning comes in. While many investors rightly start by focusing on portfolio allocation and [...]

Monthly Market Update for May 2025: A Positive Month Despite U.S. Debt Downgrade

Financial markets rebounded in May with the S&P 500 recovering its year-to-date losses. This positive month occurred against a backdrop of new trade agreements, mixed economic signals, and ongoing concerns about U.S. fiscal health. While many reports continued to show that the economy [...]

How to Tell if You’re Taking on Too Much Risk (Or Too Little!)

Imagine this: You check your retirement account and see a drop in value. Your stomach tightens. Thoughts race through your mind: Should I sell now before it gets worse? Is my retirement in danger? If you’ve ever felt this way, you may be [...]

May 2025

Beyond the S&P 500 Opportunities for Diversification

It’s well known that stocks are one of the foundations of long-term portfolios. When included as part of a comprehensive financial plan, stocks have historically created wealth and helped investors achieve their financial goals. However, a natural question is: what type of stocks? [...]

What Debt, Deficits, and the Moody’s Downgrade Mean for Investors

Moody's recent downgrade of the U.S. credit rating marks an official end to the country’s top-tier debt status. Following Fitch's downgrade in 2023 and Standard & Poor's move in 2011, Moody's decision to lower the rating from Aaa to Aa1 underscores growing concerns [...]

Disclosure: This commentary reflects the personal opinions, viewpoints and analyses of the O’Donnell Financial Services, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by O’Donnell Financial Services, LLC or performance returns of any O’Donnell Financial Services, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. O’Donnell Financial Services, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.