OUR BLOG

January 2026

Gold and Silver: Current Portfolio Perspectives

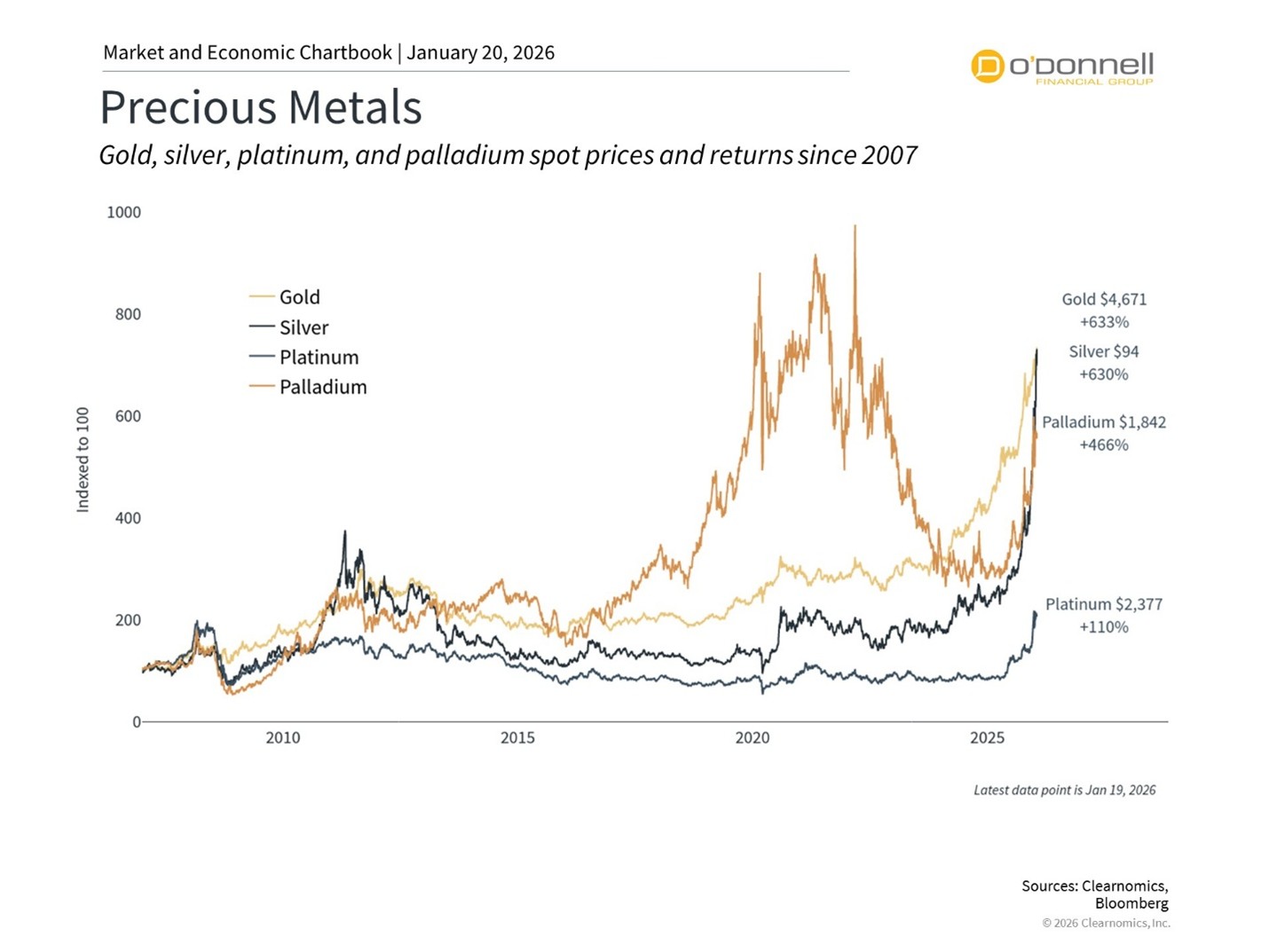

Gold, silver, and other precious metals have rallied over the past two years, capturing investor attention. Gold recently surpassed $4,700 per ounce while silver now trades above $90 per ounce, marking historic milestones for both metals. This strong recent performance may lead some [...]

Using Behavioral Finance to Set Investor Expectations

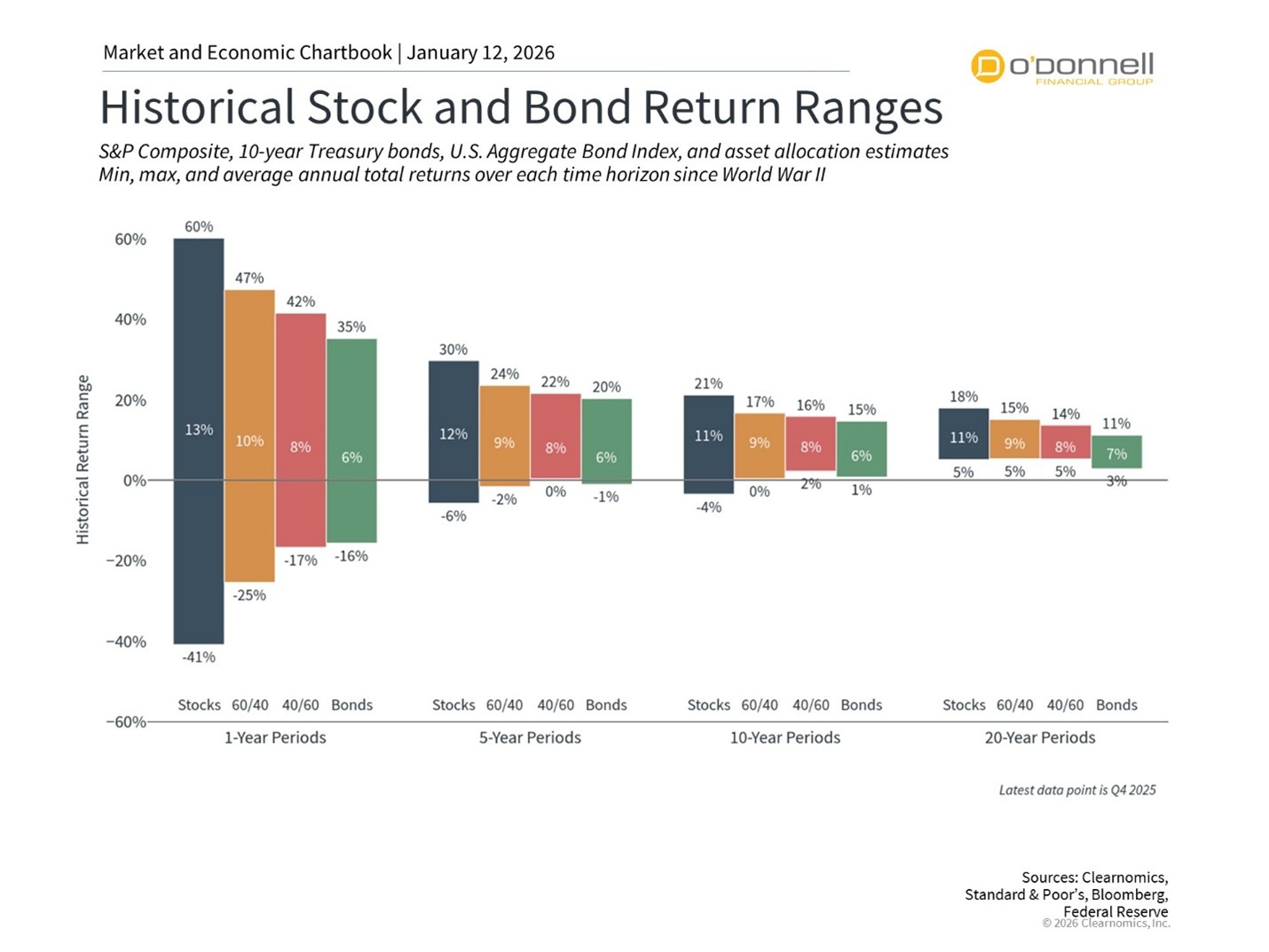

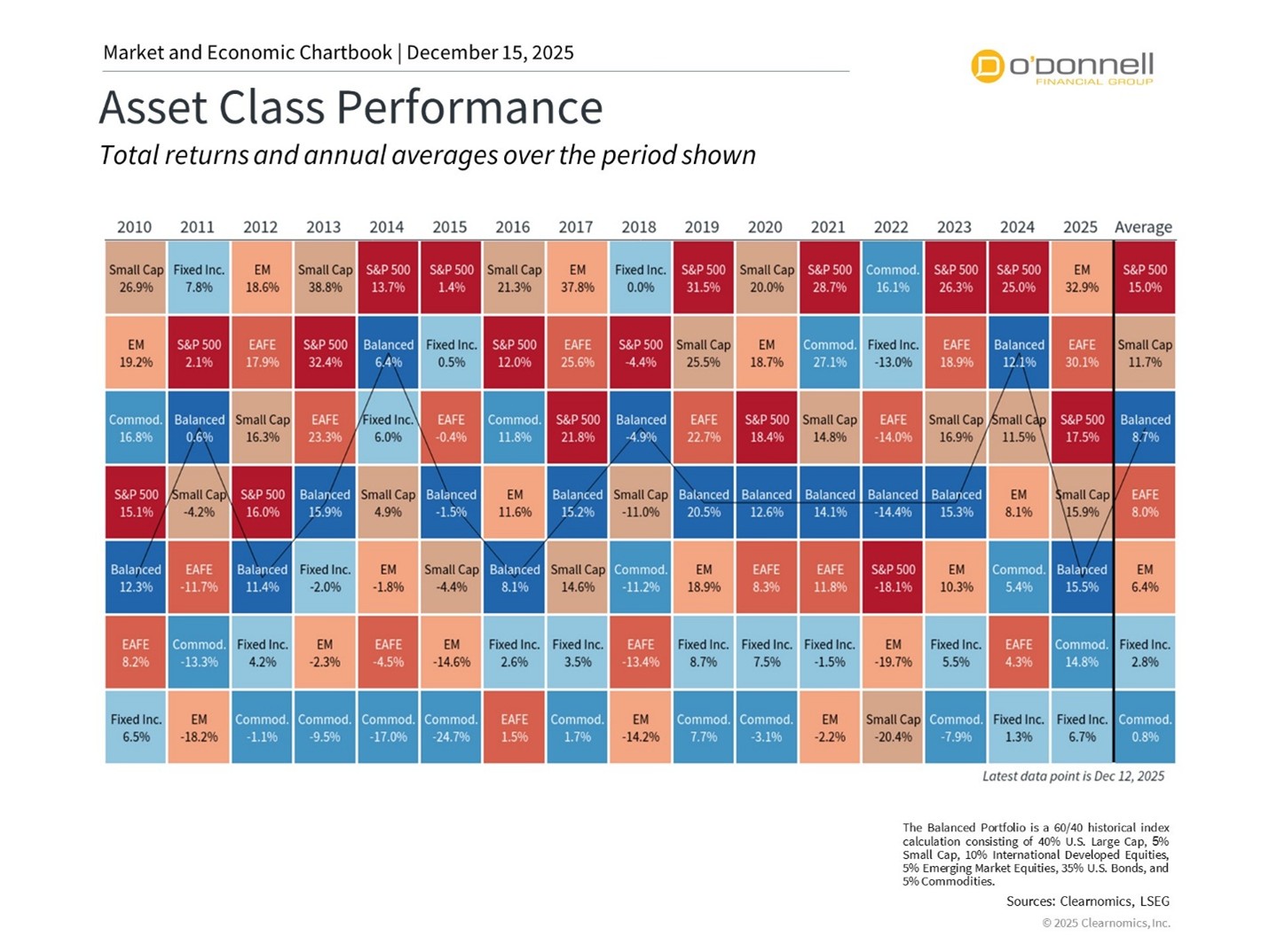

The strong stock market performance of the past several years has been positive for investors and their financial plans. At the same time, these recent successes can lead to unrealistic expectations when it comes to long-term financial goals. This is because investing and [...]

How to Build a Meaningful Retirement Life Without a Work Schedule

One of the most underestimated challenges of retirement is not financial but personal. After decades of structured workdays, many retirees find themselves asking, “What now?” While the initial freedom can feel liberating, the absence of a daily routine can quickly lead to boredom, [...]

Special Update: Venezuela, Oil, and the Impact on Portfolios

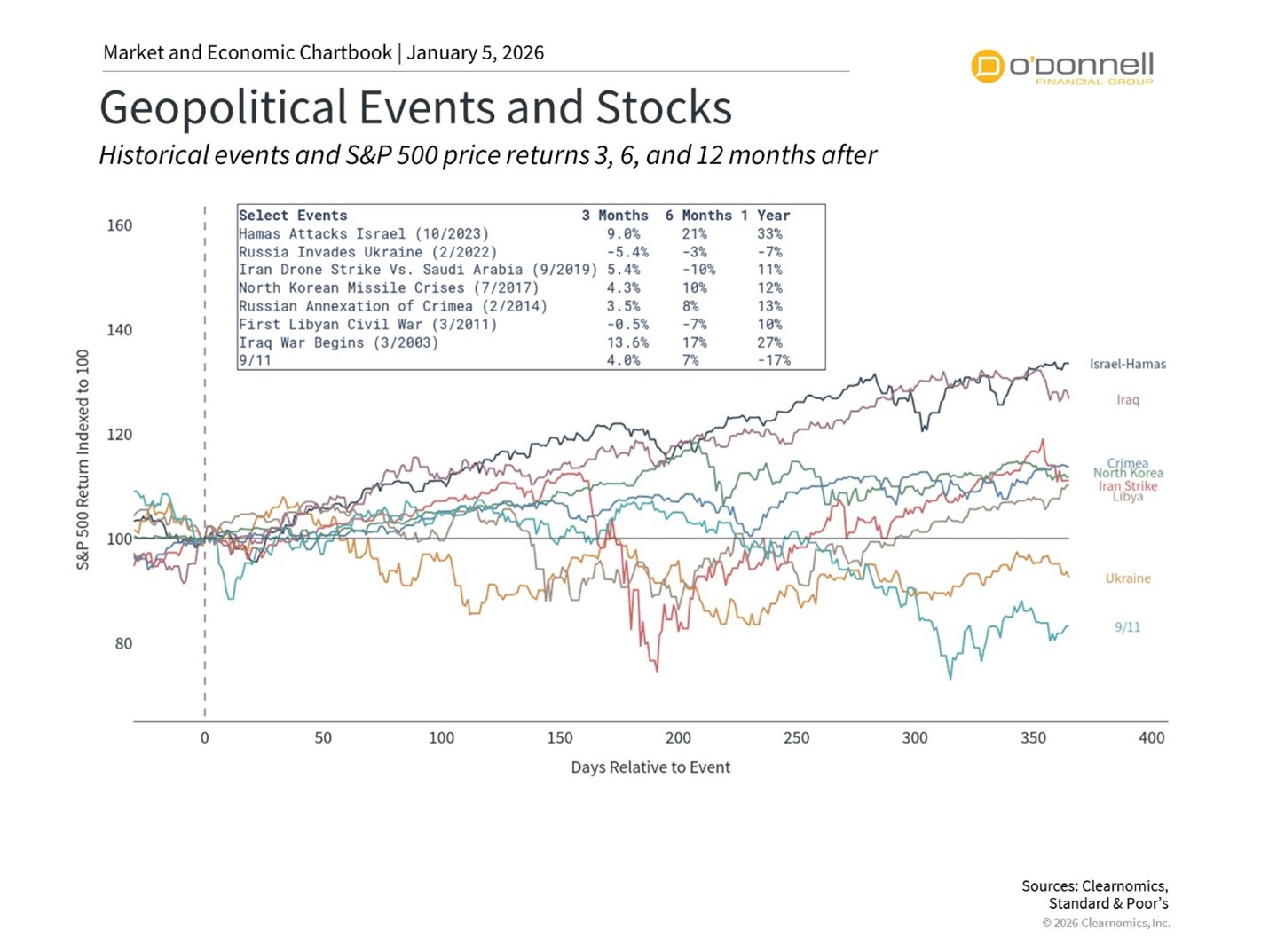

The arrest of Venezuelan President Nicolás Maduro by U.S. forces represents an unexpected and significant geopolitical event. As has been widely reported, the U.S. military successfully conducted an operation that detained Maduro on charges related to drug trafficking and corruption. President Trump stated [...]

December 2025

5 Pillars of a Well-Constructed Retirement Plan

A well-planned retirement is not a single event, but a comprehensive strategy built on several interconnected pillars. As we look ahead for 2026 and the years to follow, it's more important than ever to ensure your plan is built for stability and flexibility. [...]

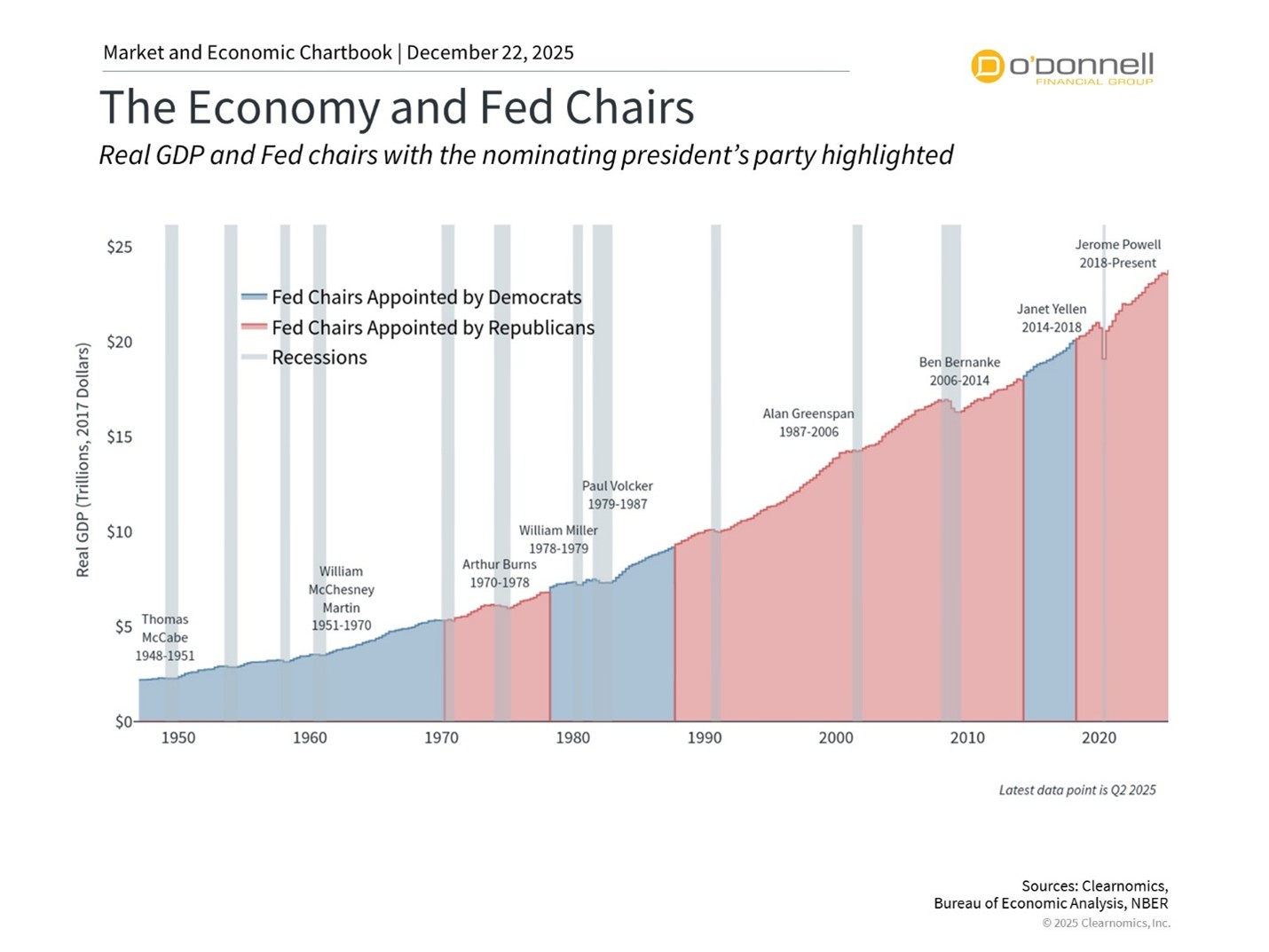

The Future of the Fed: New Leadership and Rate Cuts

For long-term investors, the Federal Reserve plays a key role in supporting the economy and financial system. This will be especially important in 2026 since Jerome Powell's term as Fed Chair ends in May, creating an opportunity for the White House to reshape [...]

2026 Outlook: 7 Key Themes for Long-Term Investors

For the sixth time in the last seven years, the stock market is on track to deliver double-digit returns. This remarkable streak, interrupted only by the 2022 inflation-driven downturn, has left many investors in a positive financial position. It's often said that the [...]

5 Year-End Financial Moves for the Holidays

As the year winds down and the holiday season approaches, December brings a natural opportunity to pause, reflect, and realign. For retirees, this season is a perfect time to give your financial life a little attention before the calendar flips to a new [...]

Disclosure: This commentary reflects the personal opinions, viewpoints and analyses of the O’Donnell Financial Services, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by O’Donnell Financial Services, LLC or performance returns of any O’Donnell Financial Services, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. O’Donnell Financial Services, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.