The Week on Wall Street

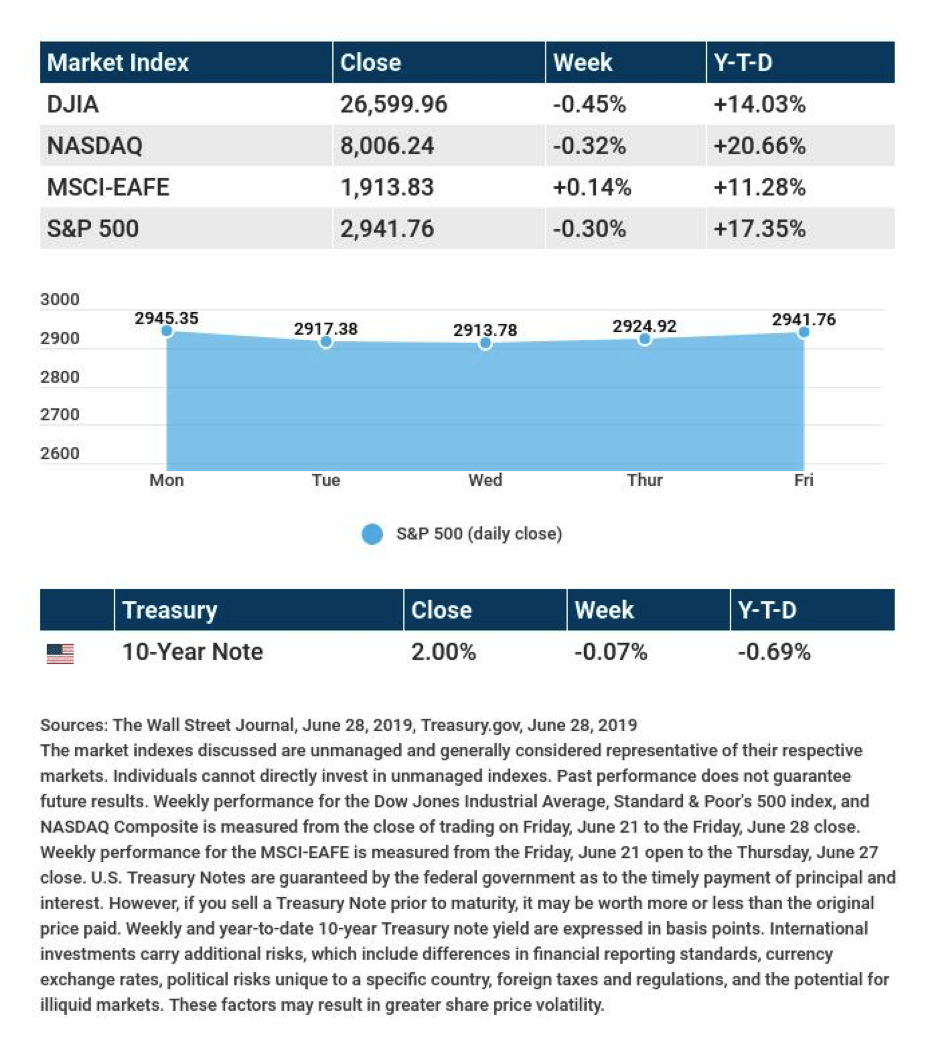

A month of gains for stocks ended with a weekly retreat. The S&P 500 lost 0.30%; the Nasdaq Composite, 0.32%; the Dow Jones Industrial Average, 0.45%. In contrast, overseas shares, tracked by the MSCI EAFE index, advanced 0.14%.[i],[ii]

Last month was the best June for the blue chips since 1938; the best month for the S&P, since 1955. The Dow gained 6.9% in June, the S&P 6.2%.[iii]

Trade Talks Could Soon Restart

All week, investors had one eye on Saturday’s Group of 20 summit in Japan, where President Trump and Chinese President Xi Jinping were slated to meet. This weekend, President Trump announced that he and President Xi had agreed to a resumption of trade talks between the U.S. and China. As part of that agreement, the U.S. is holding off on placing tariffs on an additional $300 billion of Chinese goods.[iv]

While trade tensions certainly remain between both countries, the news that formal discussions could resume may renew investor optimism about progress toward a trade pact.

Powell Cautions Against Adjusting Rates Too Quickly

In the meantime, Federal Reserve Chairman Jerome Powell attracted attention with new remarks on monetary policy. Powell stated last week that the Fed officials were “mindful that monetary policy should not overreact to any individual data point or short-term swing in sentiment.”[v]

While many traders think the central bank will lower the benchmark interest rate at its July meeting, Powell noted that there was not yet consensus for a cut among Fed policymakers.[vi]

What’s Ahead

This will be a holiday-shortened trading week. The New York Stock Exchange will close early Wednesday, and all U.S. financial markets will close Thursday for the July 4 holiday. Markets reopen on Friday.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: The Institute for Supply Management’s latest purchasing manager index for the factory sector, considered the main barometer of the state of U.S. manufacturing.

Wednesday: Payroll giant ADP’s private-sector employment report for June.

Friday: The June jobs report from the Department of Labor.

Source: Econoday / MarketWatch Calendar, June 28, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

No major earnings reports are scheduled for this week.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-COMPLIMENTARY borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[i] https://www.wsj.com/market-data

[ii] https://quotes.wsj.com/index/XX/990300/historical-prices

[iii] https://www.foxbusiness.com/markets/us-stocks-wall-street-june-28-2019

[iv] https://www.bloomberg.com/news/articles/2019-06-29/xi-trump-agree-to-restart-trade-talks-china-says

[v] https://www.thestreet.com/markets/feds-powell-suddenly-facing-dissent-says-tk-14998647

[vi] https://www.thestreet.com/markets/feds-powell-suddenly-facing-dissent-says-tk-14998647