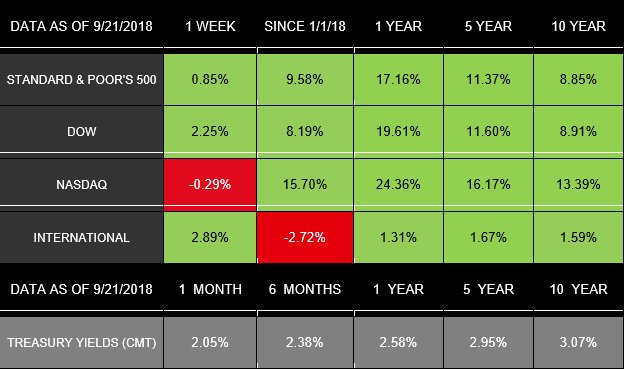

Last week brought new tariffs and data, and another look at changes coming to equity classifications. Overall, the S&P 500 gained 0.85% and the Dow was up 2.25%, while the NASDAQ dropped 0.29%. International stocks in the MSCI EAFE had sizable growth, posting a 2.89% increase.

A Look Back: Last Week’s Tariffs and Mixed Housing Data

For months, fears of a global trade war have dominated headlines. Last week, China and the U.S. launched new tariffs on each other’s products, but the latest round of this trade skirmish had an interesting effect. Rather than feeling concerned, both analysts and investors interpreted the tariffs to be lower than what they expected. As concerns about the global trade war calmed, both the S&P 500 and Dow reached new record highs.

In addition, we received some important economic information last week, including key updates on the housing industry. While the economy and markets are performing well, recent data indicates that the housing market isn’t keeping up. The data revealed:

- The Housing Market Index remained at the same relatively low point it reached in August.

- Housing starts jumped, but new building permits declined.

- Existing home sales were flat, marking the first time in 4 months that they didn’t decline.

A Look Ahead: This Week’s Global Industry Classification Standard (GICS) Update

Since 1999, the GICS has been classifying stocks based on their sectors and industries, including most of the world’s equities.

As of Monday, the S&P 500 has adjusted its sectors to change telecom into communications services and moved several big stocks into new classifications. This move is the largest GICS change since 1999 and is partly an attempt to reduce tech stocks’ weight in the markets. As technology companies have grown in the past few years, they have come to represent 26% of the S&P 500. Some experts believe that is an unbalanced level and allows tech to have too much influence on the markets.

The GICS reclassification affects many notable companies, including Facebook, Netflix, Alphabet, and Twitter. They all now join the new communications services sector. This sector name change may not actually alter the sway that technology companies have on the markets, but it will likely have other effects on investors. In the near term, volatility may increase as stocks move to new industries and fund managers adjust their holdings.

Many factors determine the reclassification’s specific effects on individual investors, so if you have questions about your portfolio, please let us know. We want to ensure you understand what you hold—and why—and how we are helping you adapt to both short- and long-term changes. If you would like guidance on any of the details we’ve shared today, we are always ready to help.

Friday: Personal Income and Outlays, Consumer Sentiment

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.