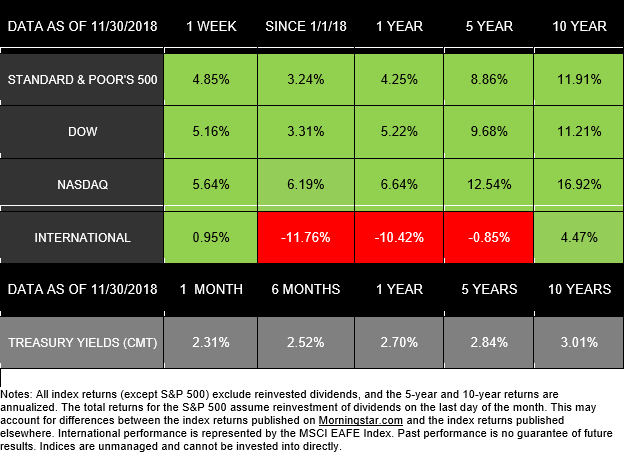

U.S. markets ended a volatile month on a high note Friday. All three major indices posted impressive increases for the week, buoyed by news from the Fed Reserve and international trade.[1] The S&P 500 jumped 4.85%, and the NASDAQ finished up 5.64%—both gains are almost 7-year highs.[2] Meanwhile, the Dow experienced a 2-year high, increasing 5.16%.[3] Internationally, the MSCI EAFE rose 0.95%.[4]

To better understand last week’s sharp rebound, let’s take a closer look at details surrounding comments by Fed Chairman Jerome Powell and various international developments.

Fed Developments

Last Wednesday, Powell inspired optimism in investors by claiming that interest rates are close to the current neutral range of 2.5–3.5%. His comments seemed to suggest that the Fed may throttle back interest rate hikes.[5] However, minutes released on Thursday from the central bank’s meeting contained no indication that the Fed had changed its policy. Therefore, we can only assume the Fed still plans on a fourth rate hike in 2018, and increases may continue during 2019, but we need to wait for more clarity from the Fed.[6]

The G20 Summit

At the annual G20 summit, leaders from the world’s 19 biggest economies and the European Union assembled in Buenos Aires. This group represents 85% of the world’s economic output and 2/3 of its population.[7] Here are a few key takeaways from the summit:

- United States–Mexico–Canada Agreement:

On November 30, President Trump met with Canadian Prime Minister Justin Trudeau and Mexican President Enrique Peña Nieto. They signed the anticipated United States–Mexico–Canada Agreement (USMCA) to replace NAFTA. With the recent U.S. tariffs on Canadian steel and aluminum causing tension, the USMCA may start to ease the strain, although some remain skeptical. Plus, the agreement still needs to pass Congress. Its true outcome is still unknown.[8]

- Trade Talks with China

President Trump and China’s President Xi met on December 1 to attempt resolving trade issues between the two countries. Since last July, the U.S. has hit Chinese goods with a total of $250 billion in tariffs and has threatened more. In turn, China retaliated by imposing $110 billion in tariffs on U.S. products.[9] Ultimately, both countries agreed to delay any increases in tariffs for 90 days, while they attempt to iron out remaining disputes. If they cannot reach an agreement, President Trump says he will raise rates from 10% to 25%.[10]

- Other G20 Concerns

Low oil prices and oversupply continue to worry investors. The leaders from two of the three largest oil-producing countries, Russia and Saudi Arabia, met to discuss reducing production and raising prices.[11] In addition to trade issues and oil, G20 leaders are grappling with different views on climate change and the new spat between Russia and the Ukraine.[12]

Stay Focused

While the Fed and geopolitical issues dominate the news cycle, we’re here to remind you to keep market fundamentals in mind. As a whole, the economy looks strong through 2018.[13] For example, last week we learned:

- Consumer confidence remains high, though it fell slightly in November. This dip follows an 18-year sustained peak in positive territory.[14]

- Q3 Gross Domestic Product increased a solid 3.5%. Business investments performed better than expected, with corporate profits boosting to a new 6-year high.[15]

- Unemployment lowered to 3.7%, the lowest it has been in at least 48 years.[16]

As always, we remain dedicated to helping you navigate your financial life amidst economic and geopolitical news. If you have questions about how this information may affect your portfolio, contact us today.

ECONOMIC CALENDAR

Monday: PMI Manufacturing Index

Wednesday: ISM Non-Manufacturing Index

Thursday: Factory Orders

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-COMPLIMENTARY borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,

Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

[4] https://www.msci.com/end-of-day-data-search

[5] https://www.cnbc.com/2018/11/28/markets-see-fewer-rate-hikes-in-powell-comments.html

https://www.cnbc.com/2018/11/28/forex-markets-dollar-the-fed-us-china-trade-in-focus.html

[6] https://www.bankrate.com/banking/federal-reserve/fomc-recap/

[7] https://www.g20.org/en/g20/what-is-the-g20

[10] https://www.cnbc.com/2018/12/01/us-china-wont-impose-additional-tariffs-after-january-1-report.html

[11] https://www.cnn.com/2018/11/30/investing/premarket-stocks-trading/index.html

[12] http://fortune.com/2018/12/01/g20-statement-2018/

[13] https://seekingalpha.com/article/4225786-u-s-good-gets

[14] https://www.marketwatch.com/story/consumer-confidence-falls-for-first-time-in-five-months-2018-11-27