OUR BLOG

October 2025

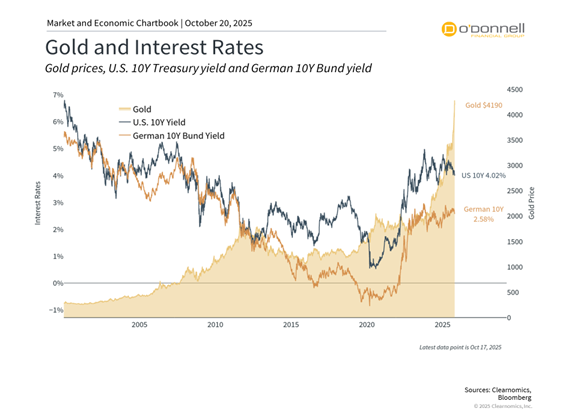

Perspectives on the Gold Rally and Dollar Debasement

As many asset classes have reached new peaks, gold has also climbed over 60% this year to above $4,300 per ounce. This rally has captured headlines and prompted many investors to wonder if it is different from past episodes. This has been referred [...]

How Can I Recession-Proof My Retirement?

When people think about retirement, they often imagine years of relaxation and freedom. But for many retirees and pre-retirees, that vision comes with an underlying concern: what happens if the market takes a downturn? Recessions are an unavoidable part of the economic cycle, [...]

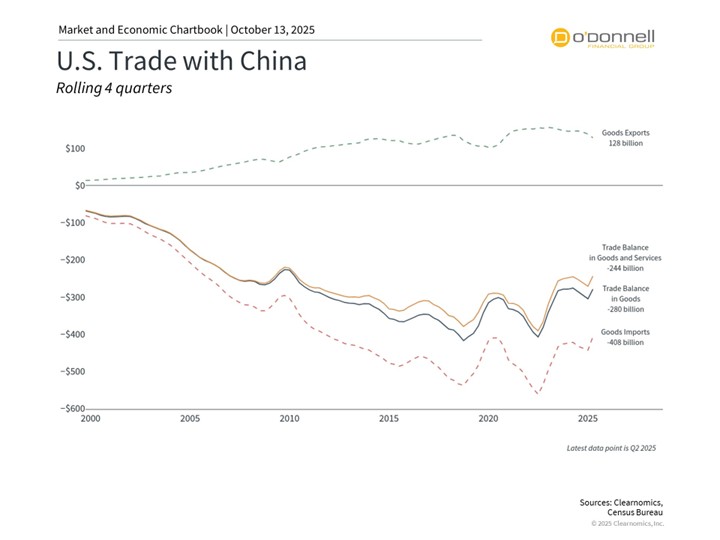

Trade War with China: The Latest Tariff Tantrum and Market Volatility

Markets have performed very well with the S&P 500, Nasdaq, and Dow all generating double-digit percentage gains—despite tariff-driven uncertainty this year. The bond market has supported portfolios as well, with the Bloomberg U.S. Aggregate Index up 6.7%, representing a historically strong year for [...]

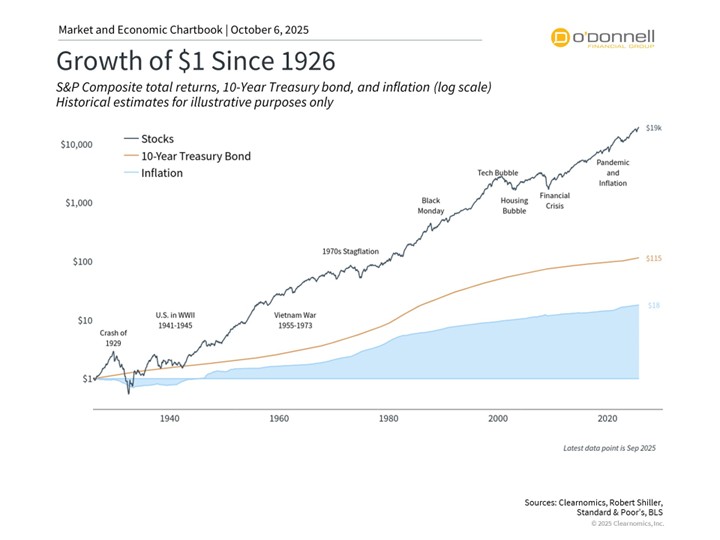

Are Investors Holding Too Much Cash?

For long-term investors, a growing challenge today is how to manage cash as short-term interest rates fall. What appears safe actually comes with real costs beneath the surface, since holding too much cash can quietly undermine long-term financial goals. This comes at an [...]

What Is a Required Minimum Distribution (RMD)?

If you’ve spent decades building up your retirement savings in tax-deferred accounts, you may have heard the term Required Minimum Distribution (RMD). But what exactly does it mean for you, and why is it so important to plan for it? Let’s break it [...]

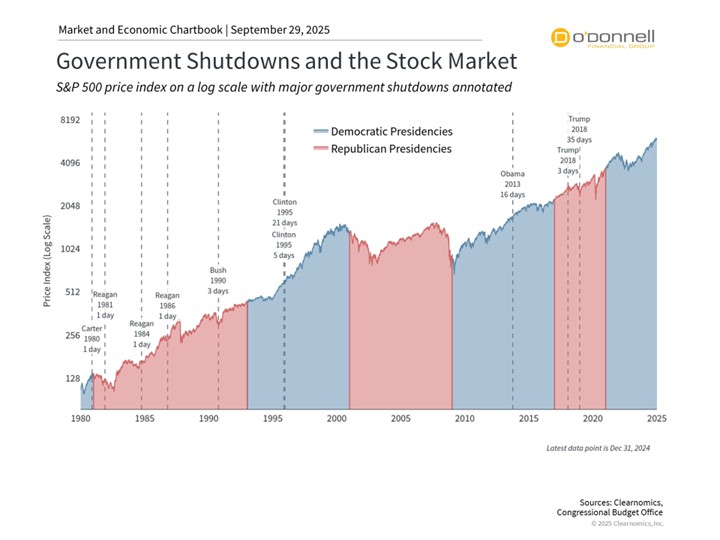

How Government Shutdowns Affect Markets and the Economy

Washington is back in the headlines as the federal government faces a shutdown if policymakers can't reach a new funding agreement. This adds to a year in which government policies around trade, taxes, immigration, and more have created uncertainty for the economy and [...]

September 2025

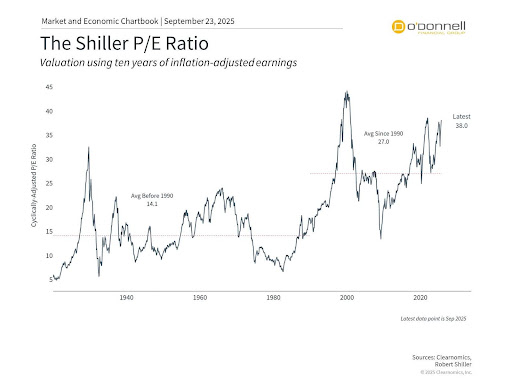

How to Navigate Fears of a Market Bubble

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, [...]

Why the Federal Reserve Works, And What It Means for Your Retirement

The Federal Reserve may seem distant or complicated, but its decisions ripple through everything from interest rates to inflation, and that may affect your retirement directly. Let’s explore why the Fed works, why its independence matters, and what that means for your financial [...]

Disclosure: This commentary reflects the personal opinions, viewpoints and analyses of the O’Donnell Financial Services, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by O’Donnell Financial Services, LLC or performance returns of any O’Donnell Financial Services, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. O’Donnell Financial Services, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.