The Week on Wall Street

U.S. stock indices saw significant ups and downs last week, with traders looking for economic cues from Treasury yields and also developments in the tariff fight between the U.S. and China.

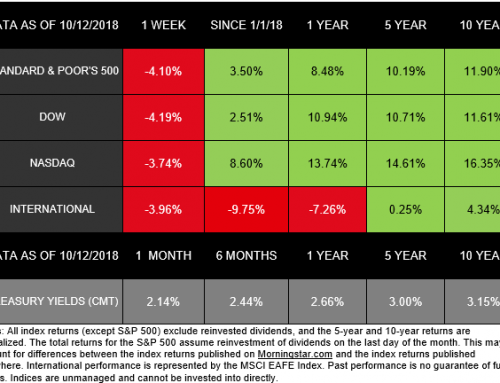

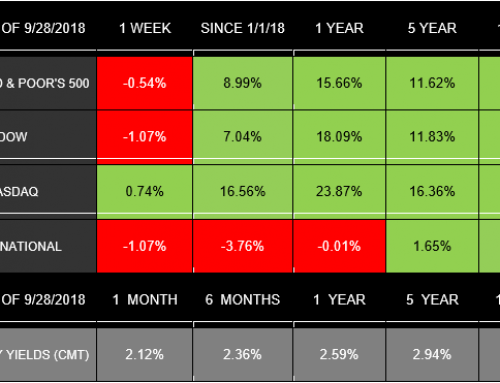

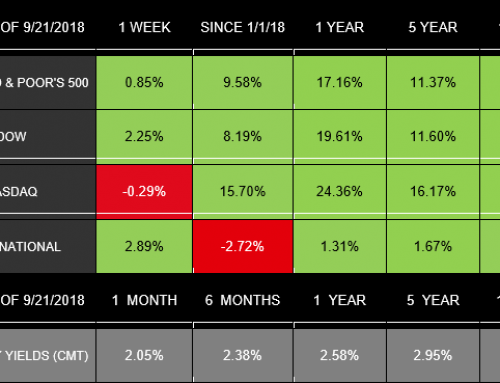

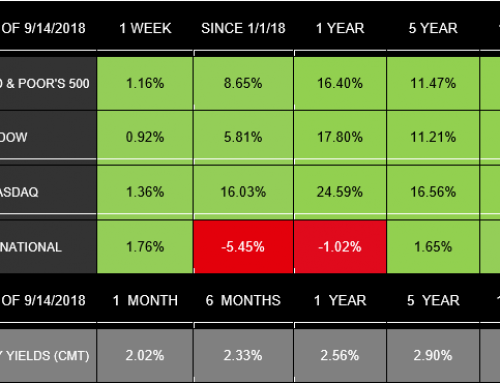

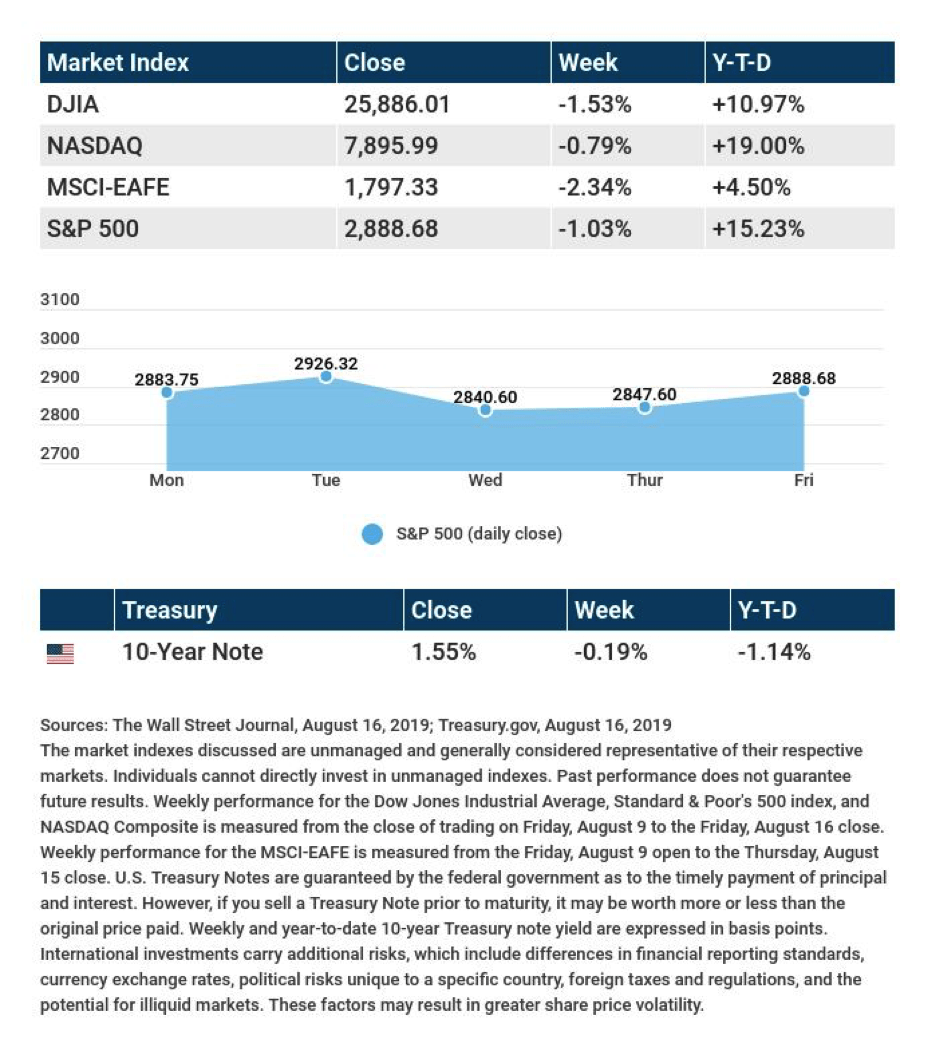

The S&P 500 lost 1.03% on the week; the Dow Jones Industrial Average and Nasdaq Composite respectively declined 1.53% and 0.79%. Overseas shares also retreated: the MSCI EAFE index lost 2.34%.[i],[ii]

Attention on the Bond Market

Wednesday, the yield of the 2-year Treasury bond briefly exceeded that of the 10-year Treasury bond. When this circumstance occurs, it signals that institutional investors are less confident about the near-term economy. That view is not uniform. Asked whether the U.S. was on the verge of an economic slowdown, former Federal Reserve Chair Janet Yellen told Fox Business “the answer is most likely no,” noting that the economy “has enough strength” to avoid one.

The demand for bonds has definitely pushed prices for 10-year and 30-year Treasuries higher, and their yields are now lower (bond yields usually fall as bond prices rise). The 30-year Treasury yield hit a historic low last week.[iii],[iv]

Some China Tariffs Postponed

Last week, the Office of the U.S. Trade Representative announced that about half the Chinese imports slated to be taxed with 10% tariffs starting September 1 would be exempt from such taxes until December 15.

The White House said that the reprieve was made with the upcoming holiday shopping season in mind, so that tariffs might have less impact on both retailers and consumers.[v]

Final Thought

Lower interest rates on bonds are now influencing mortgages. According to mortgage reseller Freddie Mac, the average interest rate on a conventional 30-year home loan was just 3.6% last week. That compares to 3.81% roughly a month ago (July 18).[vi]

30-year and 15-year fixed rate mortgages are conventional home loans generally featuring a limit of $484,350 ($726,525 in high-cost areas) that meet the lending requirements of Fannie Mae and Freddie Mac, but they are not mortgages guaranteed or insured by any government agency. Private mortgage insurance, or PMI, is required for any conventional loan with less than a 20% down payment.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: The minutes of the July Federal Reserve meeting and the latest existing home sales data from the National Association of Realtors.

Friday: Federal Reserve Chairman Jerome Powell delivers a speech at the Fed’s annual Jackson Hole economic conference on monetary policy, and July new home sales numbers arrive from the Census Bureau.

Source: Econoday / MarketWatch Calendar, August 16, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Baidu (BIDU), Estee Lauder (EL)

Tuesday: Home Depot (HD), Medtronic (MDT), TJX Companies (TJX)

Wednesday: Analog Devices (ADI), Lowe’s (LOW), Target (TGT)

Thursday: Salesforce (CRM), Intuit (INTU)

Source: Zacks, August 16, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.Diversification does not guarantee profit nor is it guaranteed to protect assets.International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-COMPLIMENTARY borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[i] https://www.wsj.com/market-data

[ii] https://quotes.wsj.com/index/XX/990300/historical-prices

[iii] https://www.cnbc.com/2019/08/15/us-bonds-30-year-treasury-yield-falls-below-2percent-for-first-time-ever.html

[iv] https://www.foxbusiness.com/economy/janet-yellen-to-wall-street-a-recession-is-unlikely

[v] https://www.reuters.com/article/us-usa-trade-china-tariffs/trump-delays-tariffs-on-chinese-cellphones-laptops-toys-markets-jump-idUSKCN1V31CX