Even in retirement, taxes are a guarantee. Your Social Security benefit, capital gains, and retirement account distributions can all be taxed, leaving you with less retirement income than you planned on receiving. Your tax burden is important to consider when planning for retirement, and can be your most significant expense. Here is how common retirement income sources are taxed.

While you will gain a new source of income in retirement through Social Security, it could also add to your tax burden. Half of your Social Security benefit is taxable if your adjusted gross income, nontaxable interest and half of your Social Security benefit equals over $25,000 for individuals and $32,000 for couples. If these equal over $34,000 for individuals or $44,000 for couples, up to 85% of your benefit can be taxed.

You may sell an investment to add to your nest egg. Investment dividends, as well as investment sales can be taxed. Investments held for less than a year are taxed at ordinary incomes tax rates. Investments held for over a year are taxed at the long-term capital gains rate, which is 15% for individuals with an income of over $39,375 and couples with an income of over $78,750, and 20% for individuals with an income of over $434,550 and couples with an income of over $488,850.

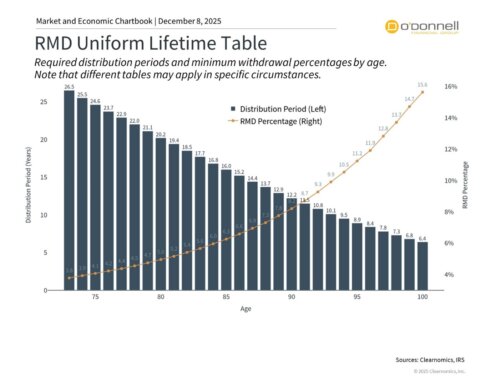

Distributions from retirement accounts count as income, and are required after age 70 ½, so make the most of your RMDs. If you turned 70 ½ in 2018, you must take your first required minimum distribution (RMD) by April 1st of this year and going forward, you must take RMDs by December 31st. If you delay your first RMD, you might need to take two withdrawals in the same year, resulting in a larger tax burden. At 70 ½ you also lose the ability to defer tax on new IRA contributions, unless you are still working or have a Roth IRA.

Keep in mind that your Social Security benefit, capital gains, and retirement account distributions can be taxed in retirement. Factoring in taxes as an expense in retirement will help you create a better plan with fewer surprises. Rather than wait until retirement to deal with new tax burdens, start strategizing now to avoid them when possible.

Don’t let your tax burden derail your retirement goals. Let the professionals at O’Donnell Financial Group help you create a retirement plan that minimizes your taxes. Click here to schedule your no cost, no obligation review today so you can start strategizing as soon as possible.