OUR BLOG

December 2025

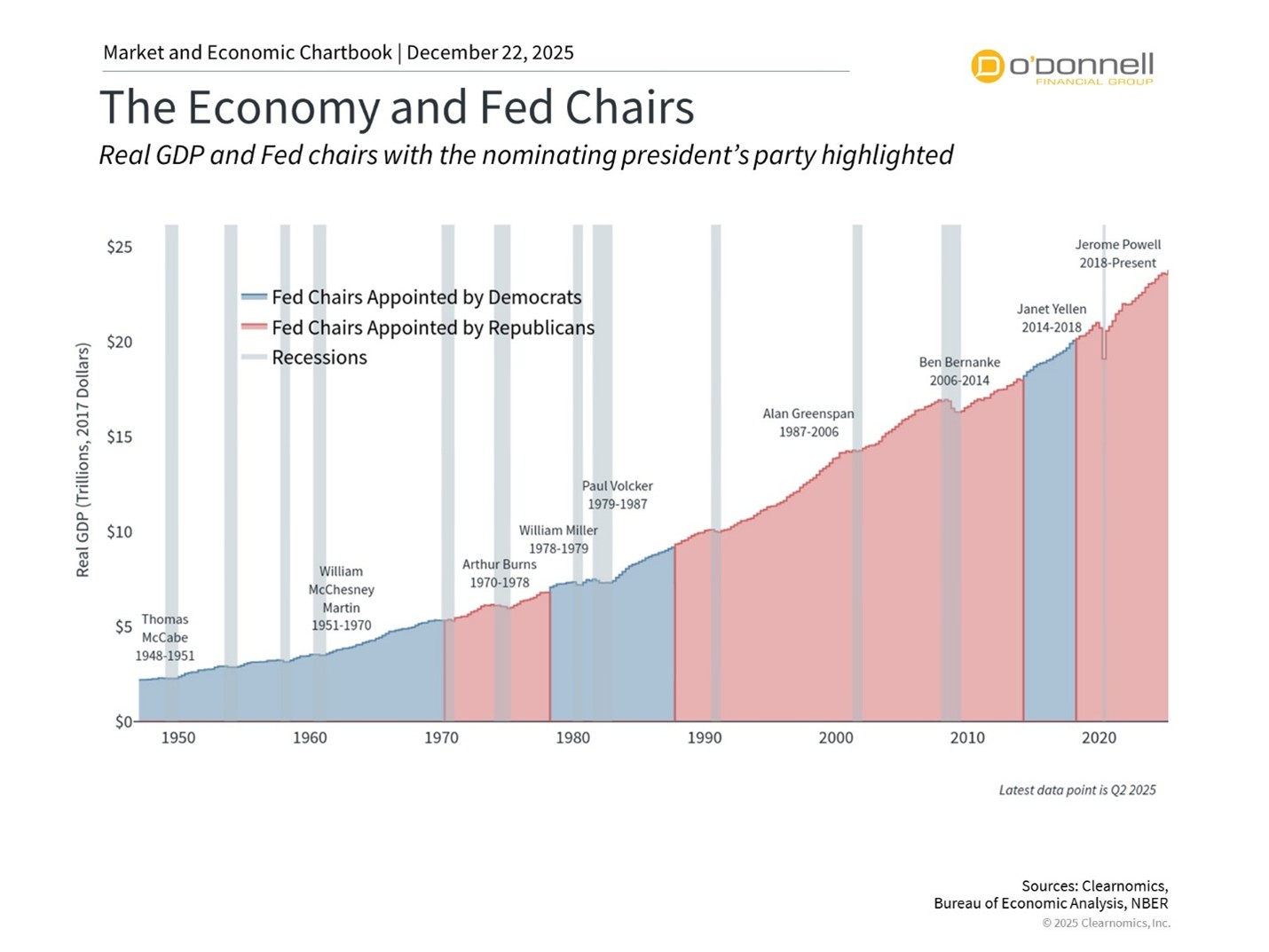

The Future of the Fed: New Leadership and Rate Cuts

For long-term investors, the Federal Reserve plays a key role in supporting the economy and financial system. This will be especially important in 2026 since Jerome Powell's term as Fed Chair ends in May, creating an opportunity for the White House to reshape [...]

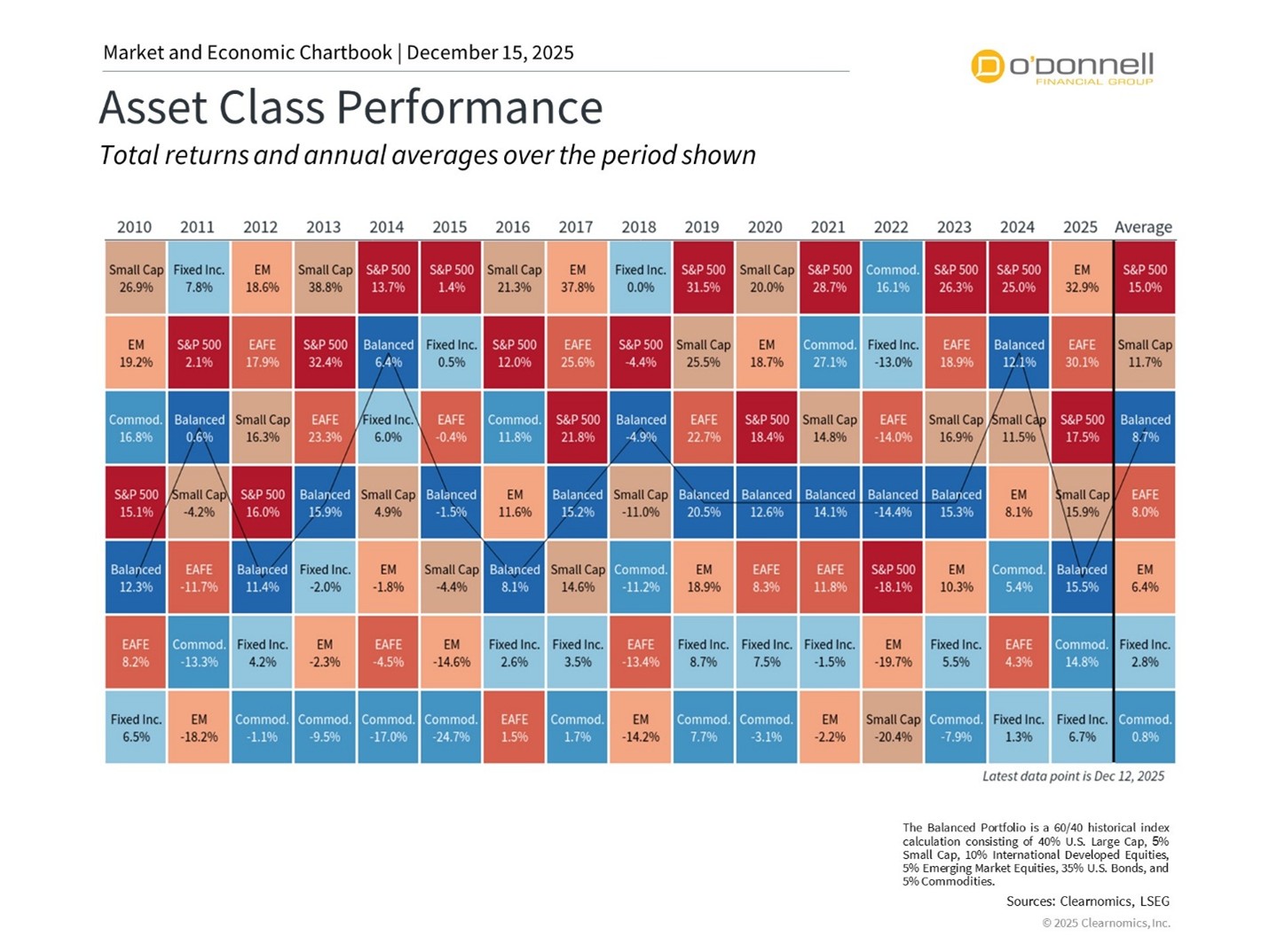

2026 Outlook: 7 Key Themes for Long-Term Investors

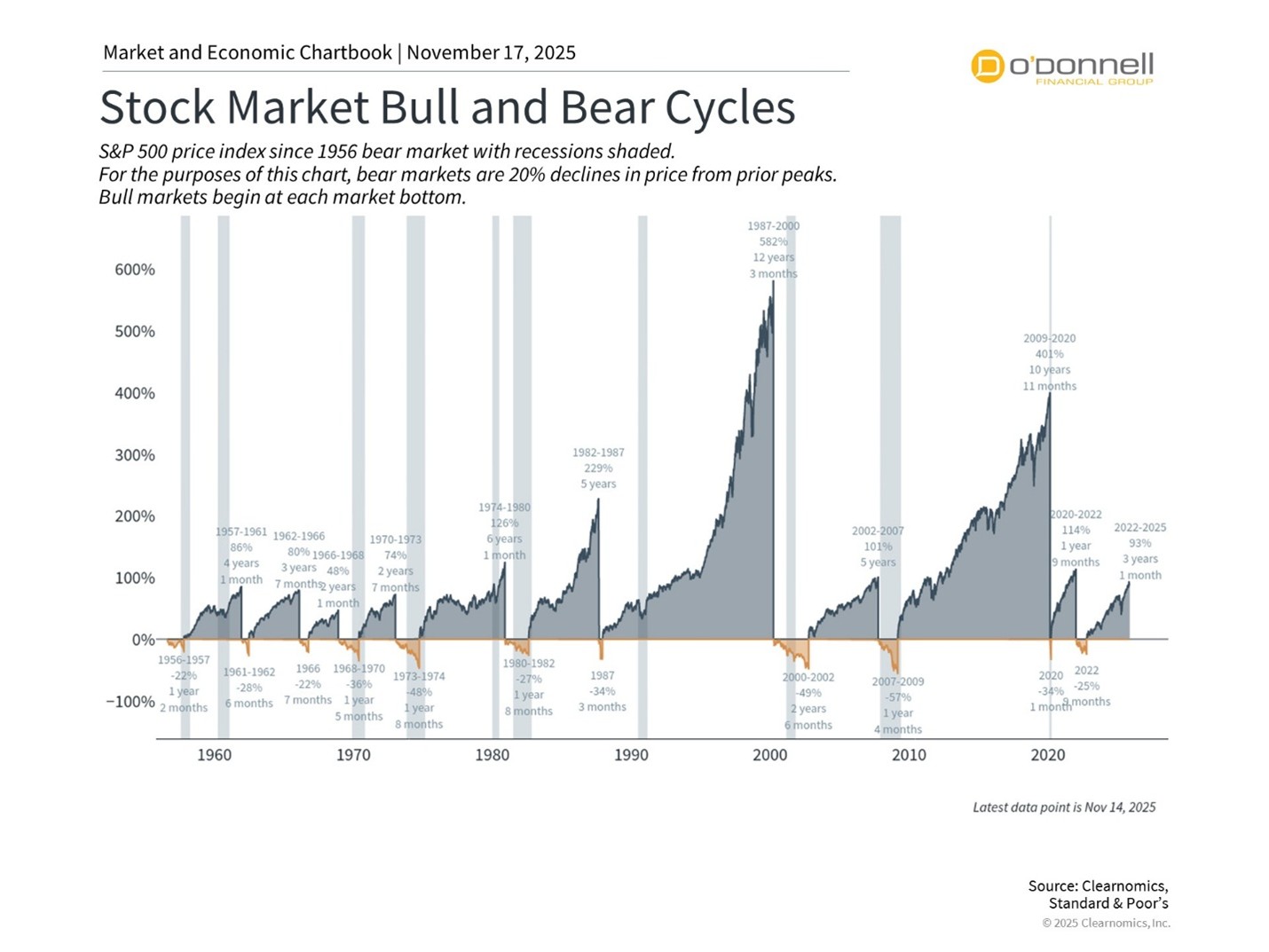

For the sixth time in the last seven years, the stock market is on track to deliver double-digit returns. This remarkable streak, interrupted only by the 2022 inflation-driven downturn, has left many investors in a positive financial position. It's often said that the [...]

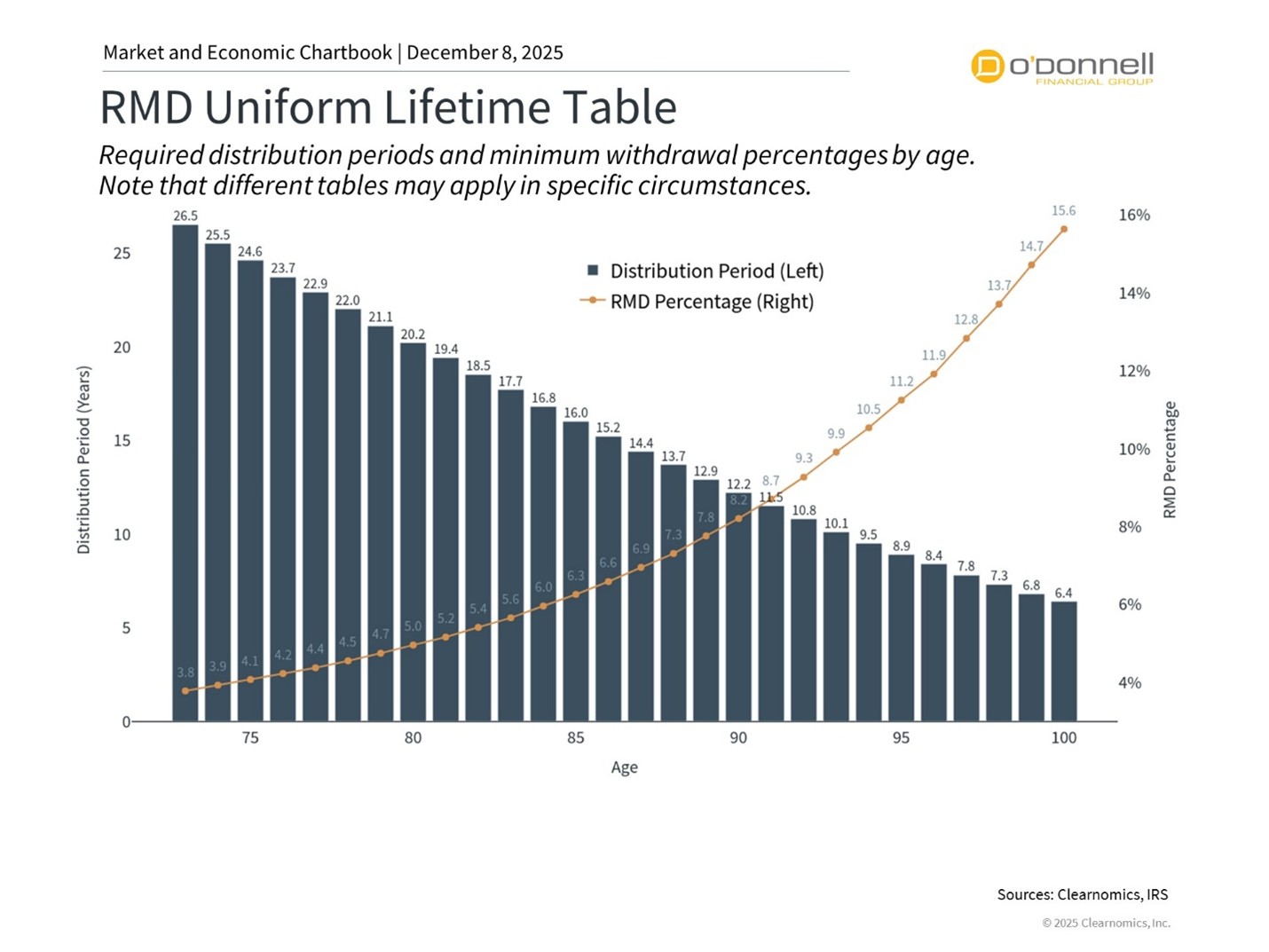

5 Year-End Financial Moves for the Holidays

As the year winds down and the holiday season approaches, December brings a natural opportunity to pause, reflect, and realign. For retirees, this season is a perfect time to give your financial life a little attention before the calendar flips to a new [...]

3 Tax Planning Opportunities Before December 31

As 2025 draws to a close, investors face important decisions that could impact their tax situations and long-term financial plans. While financial planning is a year-round activity, many calendar deadlines for tax-related activities fall on December 31. For this reason, the final weeks [...]

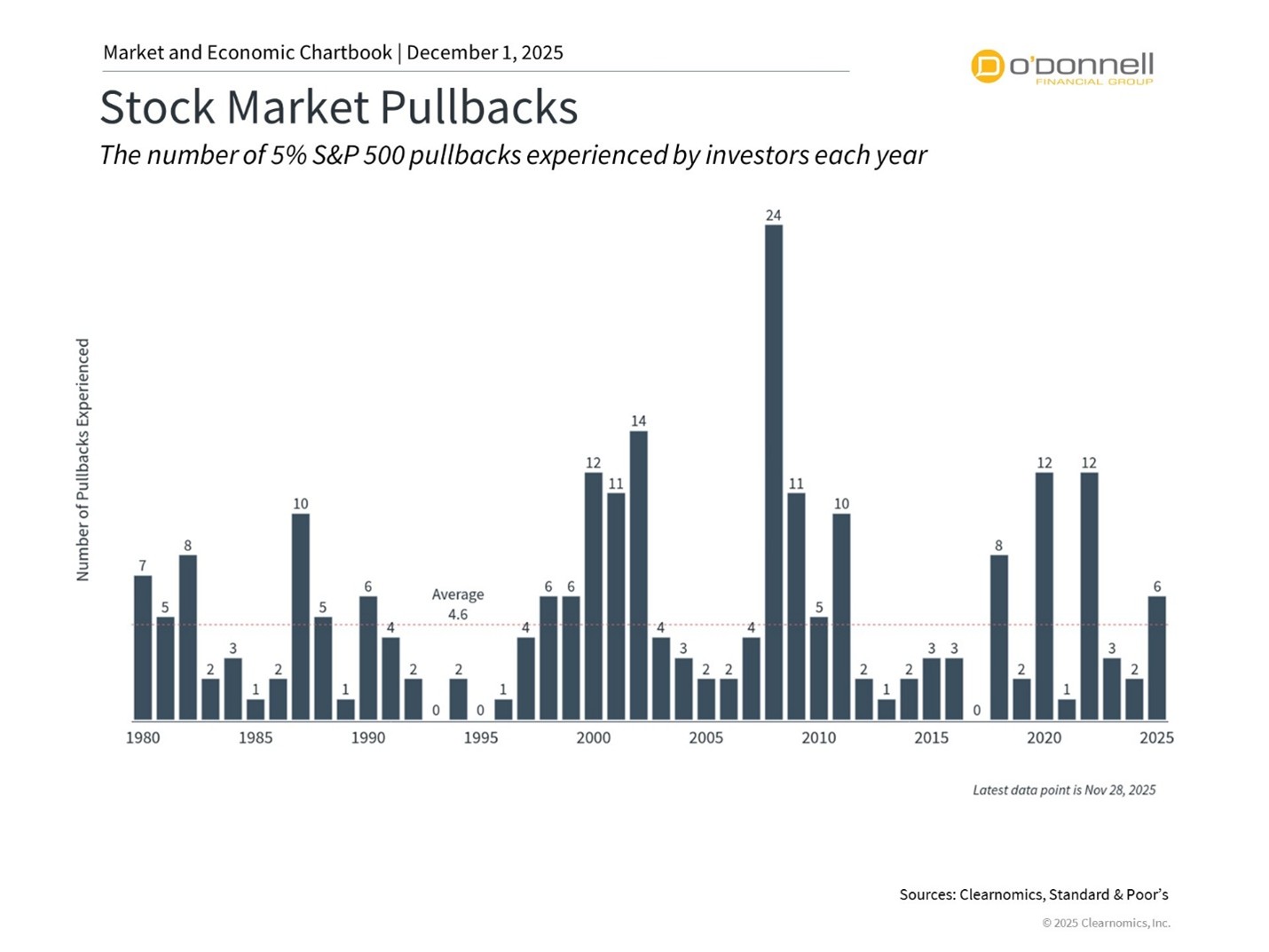

Monthly Market Update for November: Volatility Amid AI and Fed Uncertainty

In November, markets experienced a brief period of volatility that affected many asset classes. While major indices have delivered strong year-to-date returns across stocks, bonds, and international investments, investors continue to worry about artificial intelligence-related stocks and the path of Fed rate cuts. [...]

Social Security Myths to Watch Out For

If you’ve come across advice like “Social Security is going broke” or “you’re better off just waiting until 70 to claim,” you’re far from alone. These and other commonly repeated notions are persistent myths that can steer well-meaning savers off course. If you’ve [...]

November 2025

Charitable Giving: Strategies for Year End Planning

A quote often attributed to Winston Churchill is that "it is more agreeable to have the power to give than to receive." The holiday season is a natural time to reflect on charitable giving and the role it can play as part of [...]

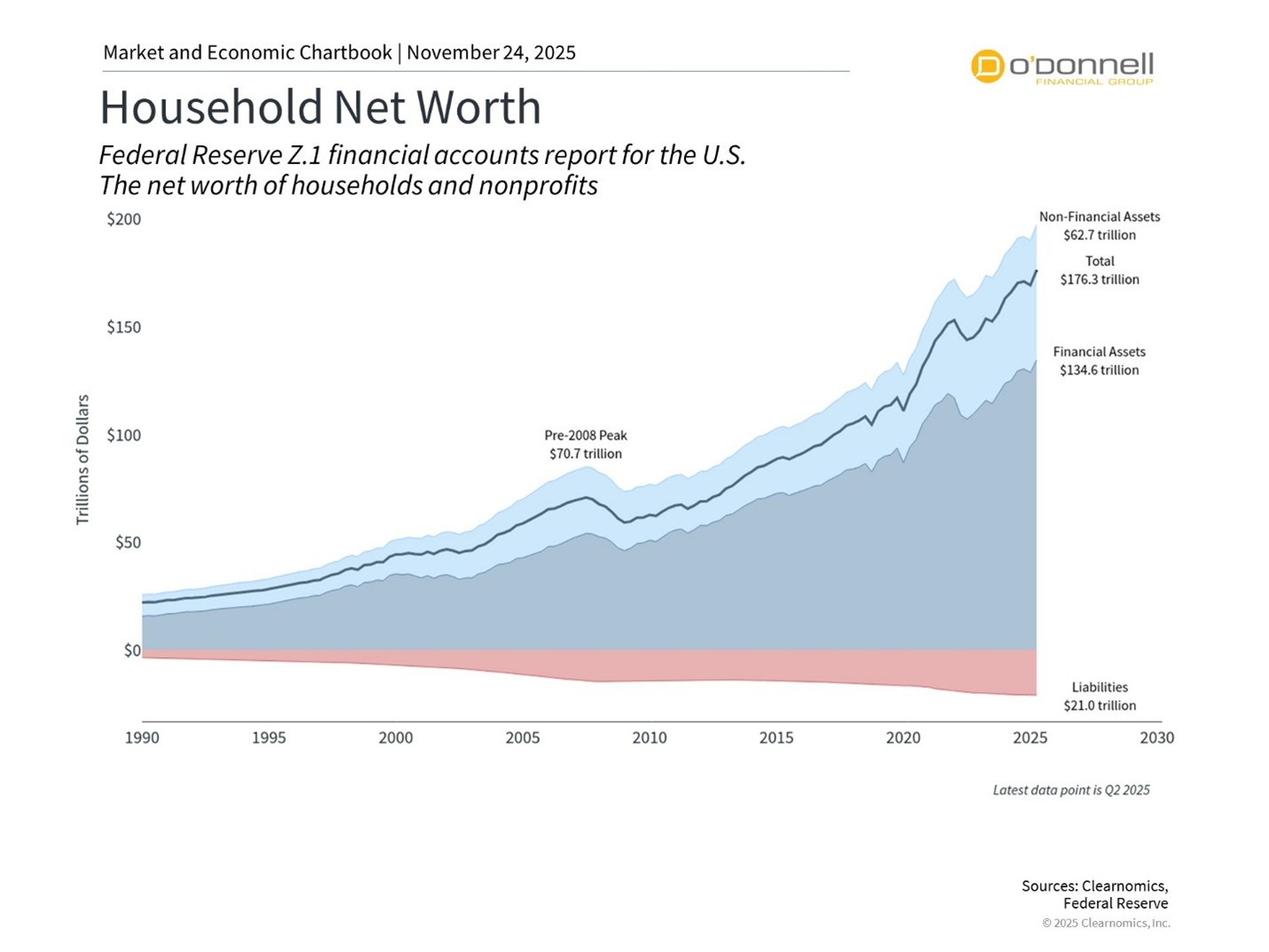

Why Investors Can Be Thankful This Holiday Season

As the holiday season begins, it’s the perfect time to pause and appreciate what we have, both in our personal and financial lives. This is particularly important since investors tend to focus on what could go wrong rather than what has gone right. [...]

Disclosure: This commentary reflects the personal opinions, viewpoints and analyses of the O’Donnell Financial Services, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by O’Donnell Financial Services, LLC or performance returns of any O’Donnell Financial Services, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. O’Donnell Financial Services, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.