OUR BLOG

February 2026

Minding Future Taxes: Traditional IRA vs. Roth IRA

When considering retirement savings options, it is paramount to understand the tax treatment of the various types of retirement accounts upon distributions. Traditional IRAs and Roth IRAs each offer unique features and have different tax implications that impact one’s retirement strategy. Here are [...]

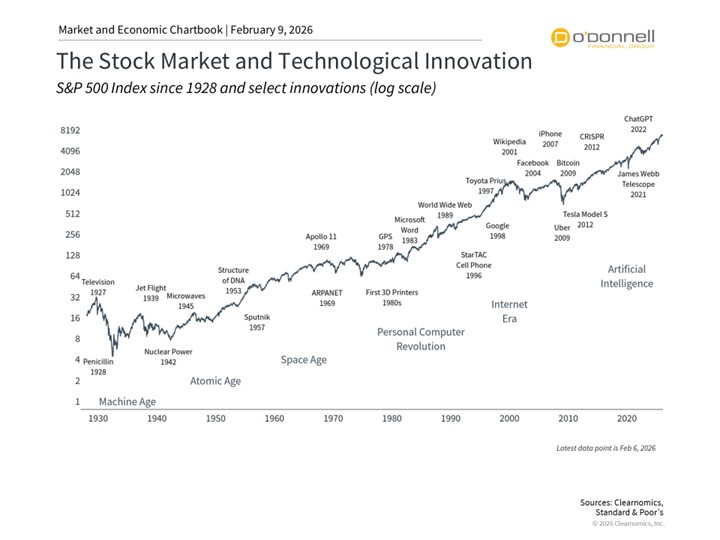

Is AI Eating the World? A Portfolio Perspective

Fifteen years ago, venture capitalist Marc Andreessen famously wrote that "software is eating the world." What he meant was that any service that could be written and automated as software, would be. This has proved accurate as cloud computing, software-as-a-service, and digital platforms [...]

Financial Planning for Newlyweds (or Nearly-Weds)

Entering into a marriage is not just a romantic commitment but also a financial partnership. For newlyweds or nearly-weds, planning future finances together can help strengthen the relationship and work toward financial independence. Here’s a guide to tackling this often-sensitive subject. […]

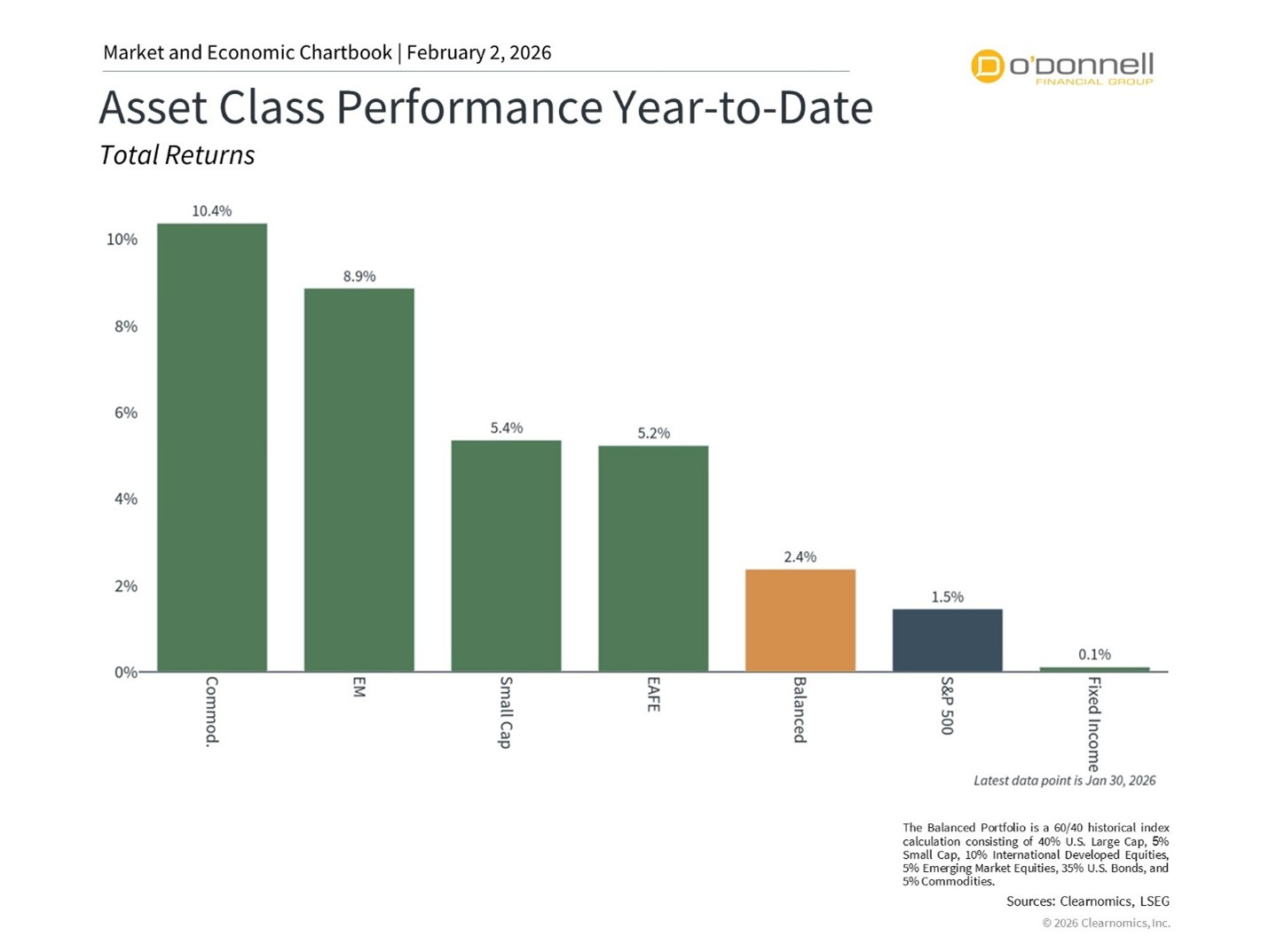

Monthly Market Update for January: Geopolitics, the Fed, and Precious Metals

The start of the year was positive for stocks and bonds, continuing the rally from recent years. This might be surprising to some investors since there were several periods of volatility driven by geopolitics and Federal Reserve policy. While headlines created short-term swings, [...]

Financial Aid Awareness Month – How to Make the Most of Financial Aid

February is recognized as Financial Aid Awareness Month, an excellent opportunity for students and families to learn more about the various types of aid available and how to maximize their benefits. Financial aid, whether in the form of grants, scholarships, or loans, is [...]

January 2026

The Importance of Earnings for Long-Term Portfolios

As the corporate earnings season ramps up, markets are shifting their focus from geopolitical concerns to tangible evidence of how businesses are performing. With the stock market hovering near all-time highs, questions around valuations and the sustainability of recent profitability trends have become [...]

Demystifying the Life Insurance Medical Exam: What to Expect During the Underwriting Appointment

Applying for life insurance often includes a step that may be unfamiliar to many: the life insurance medical exam. This examination is a fundamental part of the underwriting process. One’s health status is crucial to insurers, as it helps them assess the risk [...]

A Brief History of the Social Security COLA

Although to some of us it may seem as if Social Security has always been around, that isn’t the case. The Social Security Act was signed into law by President Franklin D. Roosevelt on August 14, 1935. Its aim was to address the [...]

Disclosure: This commentary reflects the personal opinions, viewpoints and analyses of the O’Donnell Financial Services, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by O’Donnell Financial Services, LLC or performance returns of any O’Donnell Financial Services, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. O’Donnell Financial Services, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.