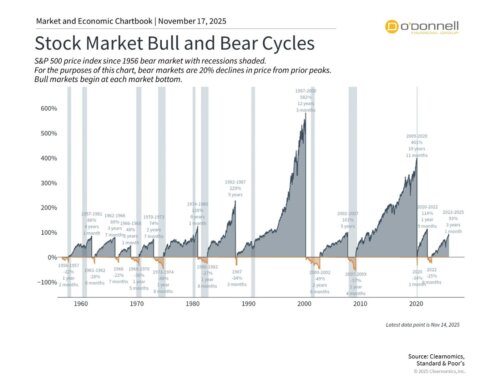

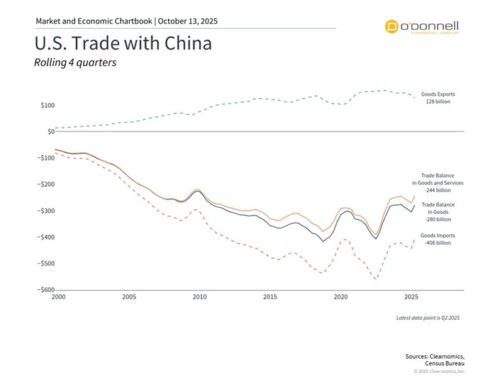

A volatile market can make anyone nervous, but it can be especially nerve-wracking for retirees and soon-to-be retirees who are concerned about protecting their nest egg for the long-term. And, one thing will always hold true: No one can predict the market’s ups and downs. This is why it’s important to create, no matter how positive or negative the stock market looks, a comprehensive retirement strategy that will help you survive a volatile market.

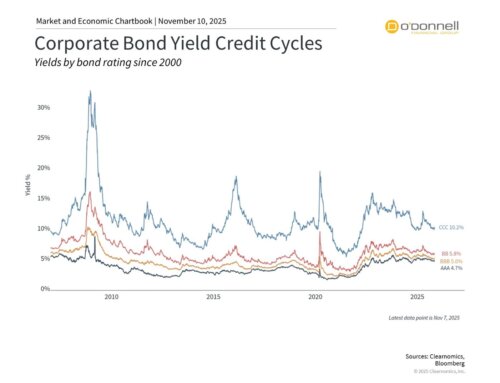

First, develop monthly income from sources other than those that rely on the stock market. This monthly income should hopefully be able to cover your living expenses. The rest of your money could be in investments that could potentially show big returns or could end up dropping if the stock market crashes. This income can be used for activities like travel or entertainment. If the market is not doing as well as you’d like, you can cut back on these bonus activities and still not worry how the bills are getting paid. Knowing that your expenses are covered can help you stay calm in unpredictable markets.

One of the best sources of guaranteed income comes from Social Security because it can withstand the stock market and inflation. It’s important to maximize this benefit so that you can have as much income each month as possible. But, because Social Security alone will likely not be enough to cover all of your expenses, you may have to look for other retirement income options to help supplement. However you decide to get your income, make sure that you can finance your retirement.

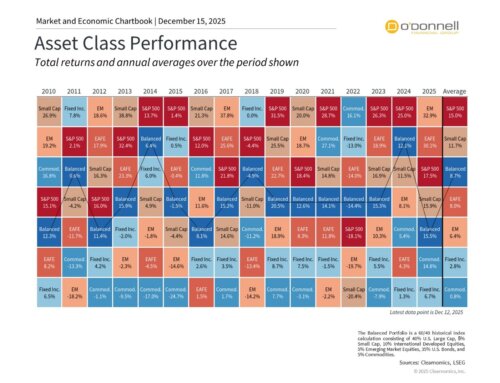

After your living expenses are covered, you can start planning for that extra income. There are many different stocks you can invest in and also different ways that you can get your payments. Some people choose to use a systematic withdrawal strategy while others use Required Minimum Distributions to determine their added annual income. It’s always best to talk to a financial advisor to see what options might be best for your unique situation.

Now, if you’re not yet retired but are quickly approaching retirement age, you might want to protect yourself more from a market crash. Especially if you are fully invested in a target date fund. If there is a gap between your retirement date and full retirement age, you’ll need to fund that time. Think about how you could protect yourself by investing in funds that won’t be affected by the crash. You should build up enough funds to cover the gaps for at least a few years.

At O’Donnell Financial Group, we want to help you make smart financial decisions so that you are prepared for whatever the stock market brings. We will work with you to create a strong financial plan that can withstand volatility. Click here to schedule your complimentary review and strengthen your financial plan.