OUR BLOG

March 2026

The Rise in Consumer Credit and How to Manage Yours

Credit is a vital component of the current economic system. Consumers frequently use credit as a financial tool for various reasons. First, it allows them to make significant purchases, such as homes and vehicles. […]

Understanding Workplace Benefits and How to Maximize Them

Workplace benefits are an essential component of an employee’s overall compensation package. These benefits not only protect one and improve the quality of life but also contribute significantly to financial independence. Let’s delve deeper into understanding these benefits and how to leverage them [...]

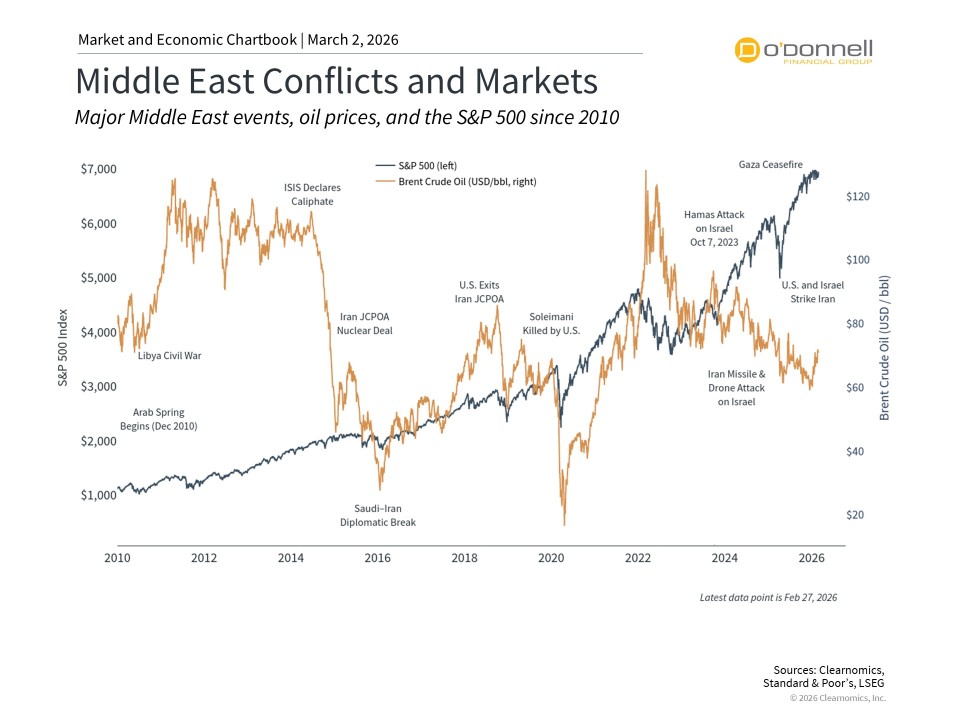

Special Update: Iran and Long-Term Investing

As you have seen in the news, the U.S. and Israel have launched military strikes against Iran, targeting its leadership, military assets, and nuclear infrastructure. Iran's Supreme Leader is confirmed to have been killed, and Iran has retaliated with missile and drone attacks [...]

National Credit Awareness Month: Understanding and Nurturing Credit Intelligence

In National Credit Awareness Month is held each March to educate the public about the importance of credit in our daily lives. This month, consumers are encouraged to review their credit reports, learn more about credit management, and take steps toward improving their [...]

February 2026

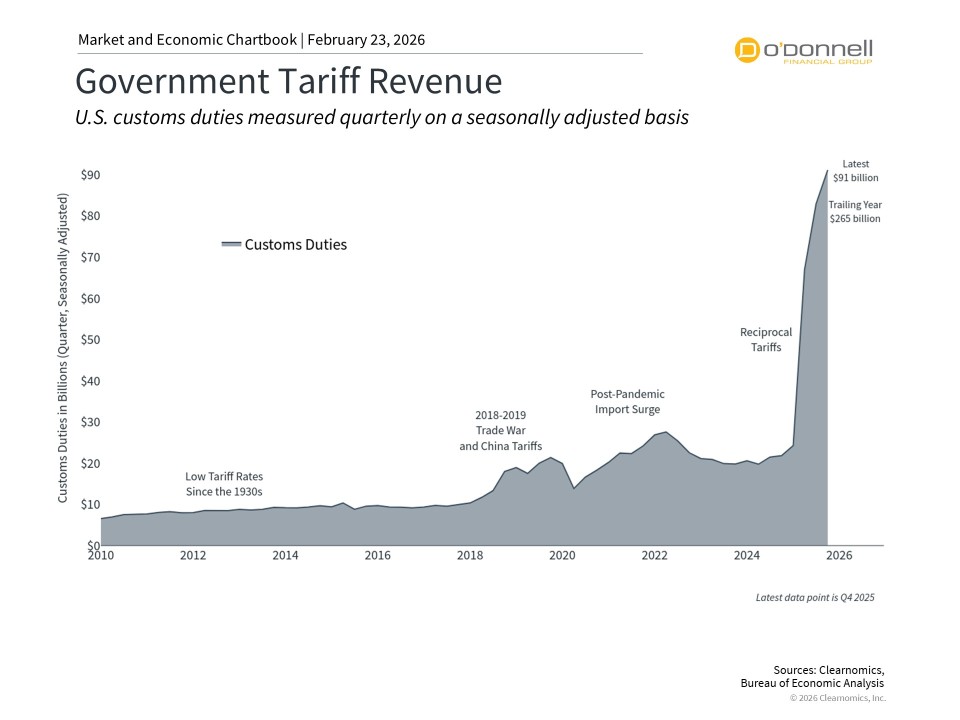

Supreme Court Tariff Ruling: Key Takeaways for Investors

After nearly a year of trade policy uncertainty, the Supreme Court's ruling that recent tariffs are unconstitutional has reset the policy landscape. Yet, as is often the case in Washington, when one chapter closes, another opens. President Trump has already signaled a switch [...]

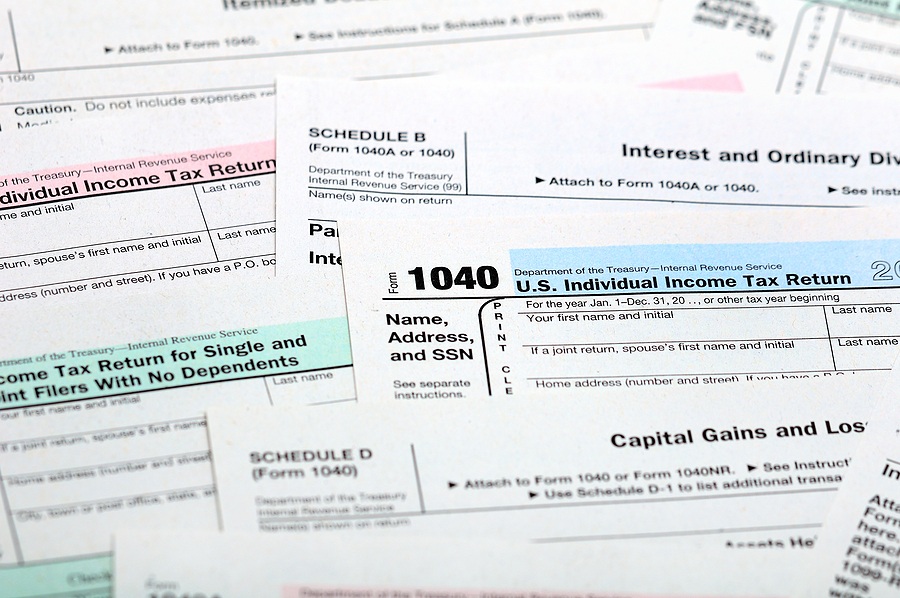

Understanding the Difference Between Income Tax and Capital Gains Tax

In the realm of taxation, two terms often surface: income tax and capital gains tax. Both are crucial aspects of an individual’s tax obligations. However, these two terms refer to different types of income taxes, each with its own rules and regulations. Investors [...]

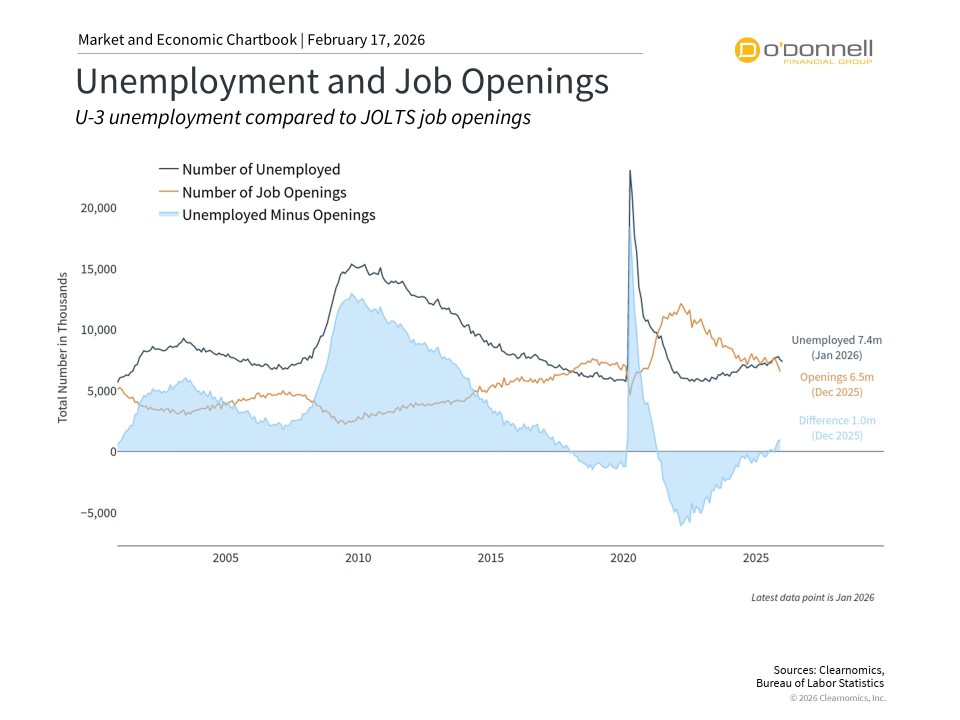

Jobs, Inflation, and Growth – Is the Economy Healthy?

The health of the economy is important to long-term investors because it drives their portfolios and their financial plans. Recent economic data points have sent mixed signals, leaving some investors unsure of what to make of the current environment. However, just as a [...]

Minding Future Taxes: Traditional IRA vs. Roth IRA

When considering retirement savings options, it is paramount to understand the tax treatment of the various types of retirement accounts upon distributions. Traditional IRAs and Roth IRAs each offer unique features and have different tax implications that impact one’s retirement strategy. Here are [...]

Disclosure: This commentary reflects the personal opinions, viewpoints and analyses of the O’Donnell Financial Services, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by O’Donnell Financial Services, LLC or performance returns of any O’Donnell Financial Services, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. O’Donnell Financial Services, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.